Financial Stability Board (FSB)

Video: BBA gives first, exclusive views on the ICB report

In an exclusive interview, the BBA discusses whether the ICB should have looked more closely at other separation models for its final report on financial stability in the UK

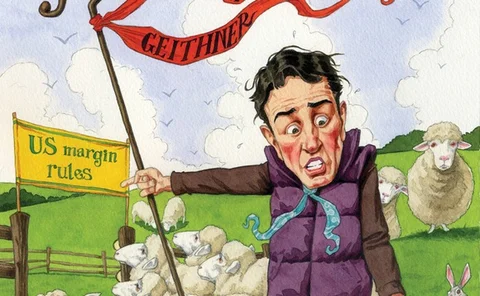

Foreign regulators leave US isolated on uncleared margin rules

The extraterritorial application of US uncleared margin proposals will make it tough for US banks to compete with their foreign counterparts unless the proposals are copied by regulators elsewhere

Risk Japan 2011: MUFG risk chief hits out at supervisors on RRPs

Masao Hasegawa, CRO at Mitsubishi UFJ Financial Group, says he was taken aback by a regulatory requirement to develop a resolution and recovery plan before year-end

SEC commissioner Casey steps down

End of term for longest-serving US regulator

Investor pull to replace regulator push on CoCos: Credit Suisse’s Ervin

A new pull for CoCos

Comment: Mario Draghi, governor of the Bank of Italy

Incoming president of the European Central Bank warns against pressure to water down regulatory reform, in this edited version of a foreward to a new Risk book

OECD calls for a permanent risk body

With the increased global threat of risk in the financial and other systems, the OECD calls for a permanent risk body within its organisation

ETF providers hit back at 'hearsay' in the press and regulator concerns about synthetic ETFs

ETF providers have been angered by the continuing focus on synthetic ETFs by regulators such as the Bank of England and the IMF. But they are particularly concerned about the bad press coverage.

Bair bids bye-bye to FDIC

Bair bids bye-bye

Peer review needed to prevent regulatory arbitrage, says AMF

Clearing rules 'won't work' unless US and European regulators can agree on detail, says senior French regulator

Basel Committee takes tiered capital approach to Sifis

Systemically important solutions

Basel Committee will not impose CoCo requirement for Sifis

Basel Committee proposes a staggered common equity capital surcharge for systemically important banks, but steers clear of contingent capital

Risk India: ETFs set to grow in India, but regulators wary of systemic risk

A panel of experts at the Risk India conference in Mumbai believes the ETF market is set for growth in India, but expressed concern about synthetic products

Supervisors seek to manage shadow banking risks

Chasing shadows

Lookback

Lookback

State Street launches 12 ETFs in Switzerland

State Street launches 12 ETFs in Switzerland

Dealers fight back amid ETF regulatory scrutiny

Holding back the regulatory tide

ETF players plan association to counter regulatory concerns

Lyxor and Deutsche Bank invite other European ETF providers to join a conference call next week to discuss the setting up of a new industry body

Supervisors on the tracks of shadow banks

Chasing shadows

More ETF regulation expected following BIS, FSB and IMF scrutiny

In the week that three intergovernmental bodies turned their focus on the ETF industry, market participants say they see more regulation ahead

FSB concerned about counterparty and liquidity risk in ETF market

FSB warns of counterparty risk due to rapid growth of synthetic ETF market; also expresses concern about on-demand liquidity in stressed conditions, particularly linked with vertically integrated providers.

Basel Committee’s Walter: Consensus reached on method to identify Sifis

The Basel Committee has now agreed on criteria for banks posing systemic threat; FSB agrees on accelerated timetable for G-20 recommendations

Regulators may keep it simple for Sifi selection

Regulators may keep the rules simple for Sifi selection process

FSB criticises industry for lack of progress on risk disclosure

Financial Stability Board says more action needed on liquidity, counterparty, structured credit disclosure practices