Basel Committee on Banking Supervision (BCBS)

Repeal CEM; reform SA-CCR

Capital framework hurts clearing resilience, Citi execs argue

UK proposes gold plating of liquidity risk rules

Cashflow mismatch risk framework aims to plug holes in Basel Committee's liquidity coverage ratio

FRTB: Asian banks criticise simpler standardised approach

Branch entities of larger banks barred from using simplified version of SBA

EBA urges European banks to step up IFRS 9 preparations

Banks not yet in testing phase face 32 basis point extra capital hit, report finds

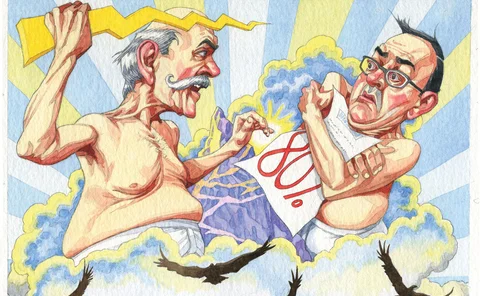

Op risk capital fight a limp political thriller

Battle to replace AMA with non-models approach was beset by nationalistic squabbles

U-turn on SMA comparability sparks anger

Three regulators echo bank dismay as key principle of op risk capital framework is abandoned

Accounting for initial margin under IFRS 13

Chris Kenyon and Richard Kenyon show why initial margin should be part of the fair value of a derivative

Focus on Basel output floor calibration misses the point

Until all the final standardised approaches are known, the floor has little meaning

Basel capital floor faces credit risk eclipse

Impact of capital floor depends on new credit risk rules and changes to treatment of provisions

US learns to play the Basel game

Mnuchin report marks a US regulatory shift – from leadership to gamesmanship

Revised SMA could allow banks to ignore past op risk losses

Leaked proposals say loss component will be left to national regulators, threatening an unlevel playing field

Three lines of defence model still evolving, say practitioners

Clearer split in responsibilities between first and second lines needed, say op risk chiefs

Don’t let the SMA kill op risk modelling

The SMA is not a good response to the AMA’s failings – but don’t throw the baby out with the bathwater

FRTB standardised approach threatens commodity hedging

Basel language would force unnatural treatment of offsetting positions

Banks worry FRTB will fracture Asian trading desks

Rules could produce “lots of little country desks”, warns StanChart market risk head

Basel opts for aggregate bank capital output floor

Banks will have more flexibility on use of internal models, but calibration still undecided

Basel group said to weigh changes to key FRTB test

EC and EBA officials criticise low pass rates for P&L attribution test

Delay revised Basel capital rules, say bankers

Regulatory heads at JP Morgan and BNP Paribas recommend regulatory recess

Custodians could face higher Basel G-Sib surcharges

Data shows removal of cap on substitutability in revised methodology would hit four banks

Banks diving into credit data pools as official support grows

European regulators embrace external data for internal modelling of credit risk capital

Banks mull dedicated IFRS 9 capital buffers

Volatility of loan-loss provisioning from new accounting standard demands additional own-funds protection, say banks

EU regulator dampens SA-CCR reform hopes

Isda AGM: EBA acknowledges approach’s shortcomings, but warns Basel is not reconsidering

Industry divided on case for European phase-in of FRTB

Isda AGM: transition period may allow time for Basel to recalibrate rules, panellists note

Giancarlo: SLR change would cut clearing capital by 70%

Isda AGM: netting of clearing collateral would boost activity without weakening banks, claims CFTC chair