Basel Committee on Banking Supervision (BCBS)

Haircutting non-cash collateral

Wujiang Lou develops a parametric haircut model to conduct sensitivity tests and capture market liquidity risk

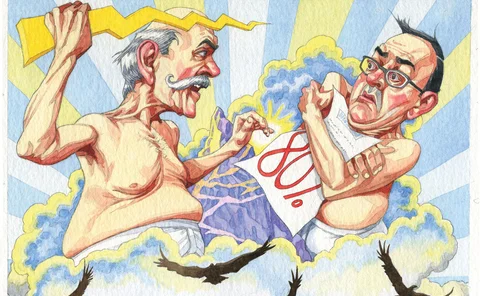

In the balance: global regulation walks a tightrope

FSB evaluation could maintain international standards or accelerate their decline

Q&A: Asia caught in the Basel crossfire, says Andrew Sheng

Veteran regulator says international standards may be the wrong medicine for emerging markets

Capital savings from new IM regime elude dealers

Slow model development and approval processes mean banks yet to see benefits expected under margin rules

Banks say Europe’s CVA proxy-spread plans lack flexibility

Dealers welcome EBA proposals but say limited number of eligible counterparties means few benefits

FRTB: proxy risk factors may trigger model failures

Swapping non-modellable risk factors for proxies may make it harder to pass P&L attribution test

FX forwards users drop EU banks over margin rule

Other dealers do not have to collect margin on physically settled forwards

CCP stress testing gets real

Quants propose technique to generate effective, plausible CCP stress-testing scenarios

Adjusting to the P&L attribution test in FRTB

Consultants offer tips on eligibility framework for new internal models approach

Repeal CEM; reform SA-CCR

Capital framework hurts clearing resilience, Citi execs argue

UK proposes gold plating of liquidity risk rules

Cashflow mismatch risk framework aims to plug holes in Basel Committee's liquidity coverage ratio

FRTB: Asian banks criticise simpler standardised approach

Branch entities of larger banks barred from using simplified version of SBA

EBA urges European banks to step up IFRS 9 preparations

Banks not yet in testing phase face 32 basis point extra capital hit, report finds

Op risk capital fight a limp political thriller

Battle to replace AMA with non-models approach was beset by nationalistic squabbles

U-turn on SMA comparability sparks anger

Three regulators echo bank dismay as key principle of op risk capital framework is abandoned

Accounting for initial margin under IFRS 13

Chris Kenyon and Richard Kenyon show why initial margin should be part of the fair value of a derivative

Focus on Basel output floor calibration misses the point

Until all the final standardised approaches are known, the floor has little meaning

Basel capital floor faces credit risk eclipse

Impact of capital floor depends on new credit risk rules and changes to treatment of provisions

US learns to play the Basel game

Mnuchin report marks a US regulatory shift – from leadership to gamesmanship

Revised SMA could allow banks to ignore past op risk losses

Leaked proposals say loss component will be left to national regulators, threatening an unlevel playing field

Three lines of defence model still evolving, say practitioners

Clearer split in responsibilities between first and second lines needed, say op risk chiefs

Don’t let the SMA kill op risk modelling

The SMA is not a good response to the AMA’s failings – but don’t throw the baby out with the bathwater

FRTB standardised approach threatens commodity hedging

Basel language would force unnatural treatment of offsetting positions

Banks worry FRTB will fracture Asian trading desks

Rules could produce “lots of little country desks”, warns StanChart market risk head