Technical paper/Algorithmic trading

Option market-making and vol arbitrage

The agent’s view is factored in to a realised-vs-implied vol model

Getting more for less: better A / B testing via causal regularisation

A causal machine learning algorithm is used to estimate trades’ price impact

Enhanced expected impact cost model under abnormally high volatility

The authors extend their impact cost model beyond the typical factors to address the larger transaction costs brought on by stock market crowding effects in times of market turbulence.

Alternatives to deep neural networks in finance

Two methods to approximate complex functions in an explainable way are presented

Linking performance of vanilla options to the volatility premium

A framework to account for vanilla options' performance in trading strategies is presented

Deep learning profit and loss

The P&L distribution of a complex derivatives portfolio is computed via deep learning

A principled approach to clean-up costs in algo trading

The opportunity cost associated with the cancelled portion of an order is quantified

Goal-based wealth management with reinforcement learning

A combination of machine learning techniques provides multi-period portfolio optimisation

An approximate solution for options market-making

An algorithm for the market-making of options on different underlyings is proposed

Quant investing in cluster portfolios

This paper discusses portfolio construction for investing in N given assets, eg, constituents of the Dow Jones Industrial Average (DJIA) or large cap stocks, based on partitioning the investment universe into clusters.

Optimal dynamic strategies on Gaussian returns

It is hoped that this paper will form a foundational approach to the study of dynamic strategies and how to optimize them. We make efforts to understand their properties without claiming to understand why they work (ie, why there are stable…

The joint S&P 500/Vix smile calibration puzzle solved

SPX and Vix derivatives are modelled jointly in an arbitrage-free setting

Connecting equity and foreign exchange markets through the WM “Fix”: a trading strategy

In this paper, the authors show the connection between equities and foreign exchange markets via this window, they leverage this connection using an algorithmic trading strategy and rank various statistical techniques used to make predictions for trading…

An optimized support vector machine intelligent technique using optimized feature selection methods: evidence from Chinese credit approval data

This paper focuses on feature selection methods for support vector machine (SVM) classifiers, checking their optimality by comparing them with some statistical and baseline methods.

The swap market model with local stochastic volatility

An easy to calibrate and accurate swap market model is proposed

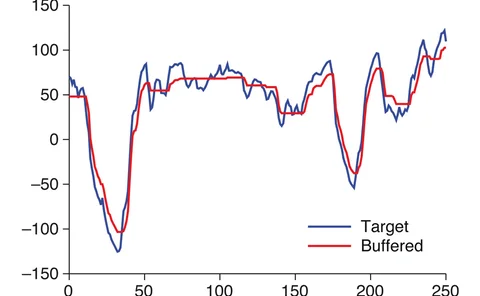

Fast and precautious: order controls for trade execution

Algo traders propose a new optimal execution algorithm with both limit and market orders

Optimal trading trajectories for algorithmic trading

This paper derives explicit formulas for the optimal implementation shortfall trading curve with linear and nonlinear market impact.

Optimal trading under proportional transaction costs

The theory of optimal trading under proportional transaction costs has been considered from a variety of perspectives. In this paper, Richard Martin shows that all results can be interpreted using a universal law through trading algorithm design

Cutting Edge introduction: The trouble with algorithmic execution

New set-up allows fast, tractable optimisation of trade execution, without neglecting downside risk

Optimal execution with a price limiter

Balancing the price uncertainty and price impact of large orders is an important issue for many market participants. While classical approaches lead to trading algorithms that are invariably price-path insensitive, in this article, Sebastian Jaimungal…