Journal of Energy Markets

ISSN:

1756-3607 (print)

1756-3615 (online)

Editor-in-chief: Kostas Andriosopoulos

Assessing the potential profitability of automated power market trading using event signals sourced from grid frequency data

Thomas Bowcutt, Patrick Denvir, Giuseppe Destino, Navesh Kumar and Chris Regan

Need to know

- Our event-driven trading strategy demonstrated superior profitability compared to a baseline average strategy, especially when reacting swiftly to grid event signals.

- Significantly higher profits were observed when the reaction time to grid events was minimized.

- Analysis showed a distinct and substantial impact of grid events on market prices, underscoring the potential for strategic trading gains.

- Utilising real-time monitoring and data analysis of grid events, as well as an algorithmic trading engine capable of conducting trades swiftly and precisely, proved crucial for the success of the strategy.

Abstract

Within a power system, the instantaneous loss of generation or import/export via an interconnector causes a disturbance in the grid frequency. In a low inertia system, it becomes increasingly feasible to identify, size, classify and locate such grid events using a suitably sensitive and accurate network of measurement devices. Loss of generation or interconnector capacity often leads to a significant change in the price stack, leading to movement in market prices as traders adjust their positions. We demonstrate that a systematic trading strategy using an event-detection signal based on public frequency data and highly accurate measurement devices can be profitable. We also assess the sensitivity of profits to the overall event-detection and trade-execution lead times.

Introduction

1 Introduction

Renewable energy (RE) is key for a greener and more sustainable supply of energy. However, with the increasing penetration of RE into the power grid, new technical and economic challenges have emerged (Camapagna et al 2022). One challenge is the need to manage low inertia levels in power grids. Here, inertia refers to the resistance of the electrical system to changes in frequency. Grid inertia is primarily provided by the rotational mass of synchronous generators, which are present in coal, gas, nuclear and biomass power plants but not in RE (eg, wind and solar) generator systems. Power grids that are largely based on RE can reach low inertia levels more frequently, yielding high risks of oscillations and grid instability (Tielens and Van Hertem 2016). For this reason, real-time and accurate monitoring of inertia is of paramount importance. In the literature, some methods based on frequency measurements and the swing equation have been proposed for the estimation and forecasting of the inertia in the grid (Lavanya and Swarup 2023; Ashton et al 2014), while a commercial solution is provided by Reactive Technologies (RT) (Bowcutt 2023). The latter relies on a micromodulator, which injects power into the grid and creates a controlled change in the frequency that is captured and processed by a fleet of proprietary devices: eXtensible Measurement Units (XMUs) (Enas et al 2022; Hosaka et al 2019).

Grid frequency must be maintained within a tight and predefined range to ensure the seamless delivery of electrical power throughout the system. When grid events (such as the unplanned outage of a power generator, interconnector or transmission link) occur, the frequency spikes in either direction (a loss of supply would result in a sharp drop in grid frequency), followed by a comparatively gradual return to baseline as the system uses pre- and post-fault mechanisms to safely rebalance itself. In markets with low-inertia systems, the frequency has a lower level of resistance to change, and as a result the link between grid events and market fluctuations becomes particularly pronounced. The reverberations of such events often result in substantial shifts in market prices.

Increasing RE penetration has had a significant impact on traditional trading strategies in the power markets: there has been a shift toward shorter trading horizons in wholesale power markets (Bray et al 2020; Hardy et al 2023; Tam and Walker 2023). As prices become less stable and predictable, traders increasingly rely on intraday and real-time markets to respond quickly to changes in RE output and grid events. In March 2023, the European Power Exchange (EPEX) reported an annual increase of 54.8% for intraday power trading, with record traded volumes seen in Austria, Belgium, Germany, Denmark, Finland, France, Great Britain (GB) and the Netherlands (EPEX 2023). Accurate forecasting of RE generation has become more important, including the use of advanced artificial-intelligence-driven weather prediction tools (Zhang et al 2022). The increased volatility in short-term power market prices and growing complexity of decentralized energy portfolios are seeing market participants increasingly adopt automated or algorithmic trading strategies (traditionally the reserve of financial markets). Savcenko (2023) suggests that 50% of all intraday continuous traded power volume in Europe in 2022 may have been executed via algorithms.

The performance of energy trading algorithms can be evaluated against specific metrics. One such metric, which is commonly used by traders (Białkowski et al 2008), is the volume-weighted average price (VWAP). This represents the average price per unit of energy traded for a specific settlement period throughout the trading session. The VWAP is calculated by the sum product of the price of each trade and its corresponding volume (in megawatt hours), divided by the total number of MWh traded over the period in question. Given its widespread usage, an improvement on the VWAP is a good metric by which we can measure the profitability of a trading strategy.

Timely information about a grid event has become a key input for power trading algorithms. In the simplest form, events can be detected by monitoring the changes in electrical frequency, voltage or the rate of frequency (Pagnier and Jacquod 2018). However, these strategies might yield numerous false alarms or “misdetections”, either due to oscillatory components or noise, or simply because the frequency reader has a low sampling rate. In this regard, some studies (see, for example, Leao et al 2020) have shown that fast, accurate event detection can be performed with the aid of artificial intelligence, which tries to recognize the event from features derived from the frequency signal. The solution provided by RT, on the other hand, exploits a fleet of XMUs that can report their data to the Reactive Cloud in real time for processing and analysis. The detection is based on a proprietary algorithm that detects key features of an event. The detection of grid events by monitoring frequency changes can be achieved in under a minute; by way of contrast, the publication of a formal notice of unplanned outages by asset operators under Regulation on Wholesale Energy Market Integrity and Transparency (REMIT) obligations takes, on average, 15 minutes.

In this paper we leverage the fast event detection provided by RT to develop what is, to the best of knowledge, a novel energy-trading strategy, and we use Brady Technologies’ algorithmic trading platform, PowerDesk Edge, to backtest this strategy. More specifically, we demonstrate with an offline analysis of trades that a systematic trading strategy that uses live frequency data to identify grid events can be profitable. In addition, we show that the profit achieved by such a strategy will increase as the overall event-detection and trade-execution lead times decrease. In other words, the more quickly we can identify grid events and act upon this information, the better positioned we are to capitalize on them.

The reminder of the paper is organized as follows. In Section 2 we provide a detailed description of the frequency data used by the algorithm and the underpinning model of the trading method. In Section 3 we dive into the experiment with a description of the market data and a comparison between our results, a baseline trading strategy and the proposed event-driven strategy. Finally, in Section 4 we summarize our observations and state our conclusions.

2 Event-driven trading algorithm

2.1 Measurement data

Event information is obtained from the measurements performed by the fleet of RT XMU devices. Generally, the XMUs are capable of accurately measuring raw power system metrics, such as the voltage phase and frequency. They are small sized and typically connected at 230 V via a plug socket. Global positioning system (GPS) connectivity enables time-aligned measurements, and broadband or mobile connectivity allows data transmission directly to the cloud via an encrypted internet connection. In the cloud, these measurements are processed (filtered and analyzed) to detect the event start, to estimate the event size and to infer the cause (interconnector, transmission, generation and load). More specifically, the event detection is based on the analysis of the frequency and the rate of frequency change. Event sizing leverages the RT inertia measurements and, finally, events are classified by means of a machine-learning method trained on frequency measurement features.

2.2 Grid event reaction strategy

In the GB electricity market, energy can be traded as a contract for delivery of energy for a half-hour period. These half-hour delivery periods are called settlement periods.11 1 URL: http://www.elexon.co.uk/glossary/settlement-period/. There are 48 settlement periods on days when the GB market is not going though a clock change from British summer time to Coordinated Universal Time (UTC).

On the GB EPEX Spot intraday market,22 2 URL: http://www.epexspot.com/en/basicspowermarket#day-ahead-and-intraday-the-backbone-of-the-european-spot-market. market participants trade continuously, 24 hours a day, with delivery on the same day. Participants submit orders, comprising a volume and price at which they are willing to buy or sell. As soon as a buy- and sell-order match, the trade is executed. Electricity can be traded up to 15 minutes before the start of delivery and through hourly, half-hourly or quarter-hourly contracts.

Considering the above context, let s denote the settlement period being traded, which can vary from 1 to 48. Let 𝒯s be the set of all timestamps t for which a trade for the settlement period s is executed. More specifically, t∈𝒯s with ts0≤t<tsgate, where ts0 and tsgate are the start time and the gate-closure time for the settlement period s. We assume a net open position of 50 MWh to buy or sell and assume that this position will be closed under a single contract comprised of a single order.33 3 While theoretically possible and allowed on the EPEX SPOT, in reality the contract will be made up of many orders comprising different sellers. These orders constitute the order depth, which is beyond the scope of this study.

The proposed grid event-reaction strategy is an opportunistic strategy, which consists of the following. When a grid event occurs at event time tE, we take a decision with reaction time R to buy or sell within settlement period s at price pstE+R for a trade volume V=±50 MWh. Clearly, this strategy will have a greater impact on settlement periods that are closer to the event time tE that those are far away. More specifically, the efficacy of the proposed strategy can be measured by comparing the price at which the trade is completed (pstE+R) with the portion of the VWAP (Białkowski et al 2008) conditioned by the event, ie, the tE-truncated VWAP that is given by

VWAPstE≜∑tsgatet>tEvstpst∑tsgatet>tEvst, | (2.1) |

where vst and pst refer to the volume and price taken at time t for the settlement-period s, respectively.

Therefore, with the above definition, we can formulate the relative “profit”, α, obtained for a sell/buy position as

α=V(pstE+R-VWAPstE). |

3 Case study

In this section, we describe in detail a trading experiment with historic trade and order data (available, by subscription, via the EPEX Spot Market Data Service) for the half-hourly continuous intraday GB market. Our objective is to compare the relative profit and loss of a strategy informed by grid event signals for a range of event reaction times with a baseline simple averaging strategy. We also investigate the dependency between the profit α and the reaction time R for both the settlement period with the closest upcoming gate closure (“Half Hour 0”, henceforth “HH0”) and the subsequent settlement period (“Half Hour 1”, henceforth “HH1”).

3.1 Grid events data set

We use GB market grid events (available via the RT Tradenergy service) over the period from August 4, 2022 to June 14, 2023. Focus is on grid events over 300 MW that resulted in a reduction in frequency. We ignore grid events associated with loss of load or exporting interconnectors that will likely decrease prices (a potential area for future study). This provides a sample of 90 grid events: 58 associated with loss of generation; 10 from loss of an importing interconnector; and 22 transmission-related issues. While the source data set includes sizing and classification of events by generation, transmission or interconnector, the trading strategy analyzed does not attempt to use this information, but focuses simplistically on event detection as the input signal. This data set includes a proportion of false positives (ie, events detected but not subsequently confirmed by market publications); these are included in the analysis and reflected in the overall assessment of the event strategy profitability.

3.2 Baseline strategy

The baseline strategy is simply defined by the action of purchasing a total of 50 MWh of power in increments distributed evenly in time between the event detection time and the end of trading for the relevant half-hourly continuous intraday GB product. It can easily be demonstrated that this strategy achieves a truncated VWAP (ie, trade prices before the event are ignored) for the 50 MWh purchase.

3.3 Event strategy

We use Brady Technologies’ PowerDesk Edge backtesting platform with the grid event data set to simulate an “aggressor strategy” whereby, based on the event detection time plus some increment of time (the “reaction time”) reflecting the combined lead time for event identification and trade execution, a 50 MWh position is closed by purchasing (“aggressing”) against available open market sell orders.

3.4 Evaluation method

The event strategy will be considered more profitable than the baseline strategy if, at the event detection time plus the reaction time, orders are available in the market at a price lower than the VWAP of trades executed after the event detection time. Conversely, if the VWAP of trades after the event detection time is less than the orders available, a relative loss will be accrued to the event strategy.

Further, the profit and loss for the 90 sample events were assessed with reaction times of 0s, 10s, 20s, 30s and 50s after event detection. We considered the profit and loss associated with the next two half-hourly products open for trading at the event detection time (HH0 and HH1).

3.5 Example event trades

The example in Figure 1 shows traded prices for the 11:00–11:30 delivery period, before and after an interconnector event on June 8, 2023. Here we can see that the market was trading at around £47/MWh prior to the interconnector trip and reached a peak of £110/MWh after the interconnector trip. In this example, the baseline strategy would have achieved a VWAP of £87.18/MWh for post-event trades, whereas the event strategy would have achieved a price of between £50/MWh and £75/MWh (depending on the reaction time). For this event, the REMIT notice was published on ELEXON BM Reports44 4 URL: http://www.elexon.co.uk/knowledgebase/what-is-bmreports-com/. on June 8, 2023 at 10:41:28, by which time the price had increased to £90/MWh.

3.6 Liquidity constraints

Execution of the strategies was constrained based on market liquidity, such that trades were only considered feasible where there was an existing open market order available to aggress. This approach is potentially more conservative than a strategy based on initiating market orders based on the event signal but ensures that we only measure trades that would have had a viable counterparty at the assumed execution time.

4 Results

Based on the sample events analyzed, the event strategy was shown to be more profitable overall than the baseline strategy. Further, profitability increased considerably as the overall reaction time reduced.

4.1 Post-event price changes

The Mann–Whitney U test55 5 URL: https://en.wikipedia.org/wiki/Mann%E2%80%93Whitney_U_test. was used to compare the price of the market for equal-sized populations before and after the event, with the null hypothesis being that there was no significant change in price distribution at a reasonable significance value of 0.05. Based on this analysis, there are three takeaways. From 1s to 10s after the event there were no significant changes in the price of orders. From 11s to 30s after the event the market sees movement, with the p-value getting very close to 0.05. From 30s onward, the p-value is above 0.05, indicating significant order lifting along with bids chasing the raised orders. We can conclude that there is a definite raise in price after a grid event, for which the magnitude increases with time.

4.2 Probability density plots

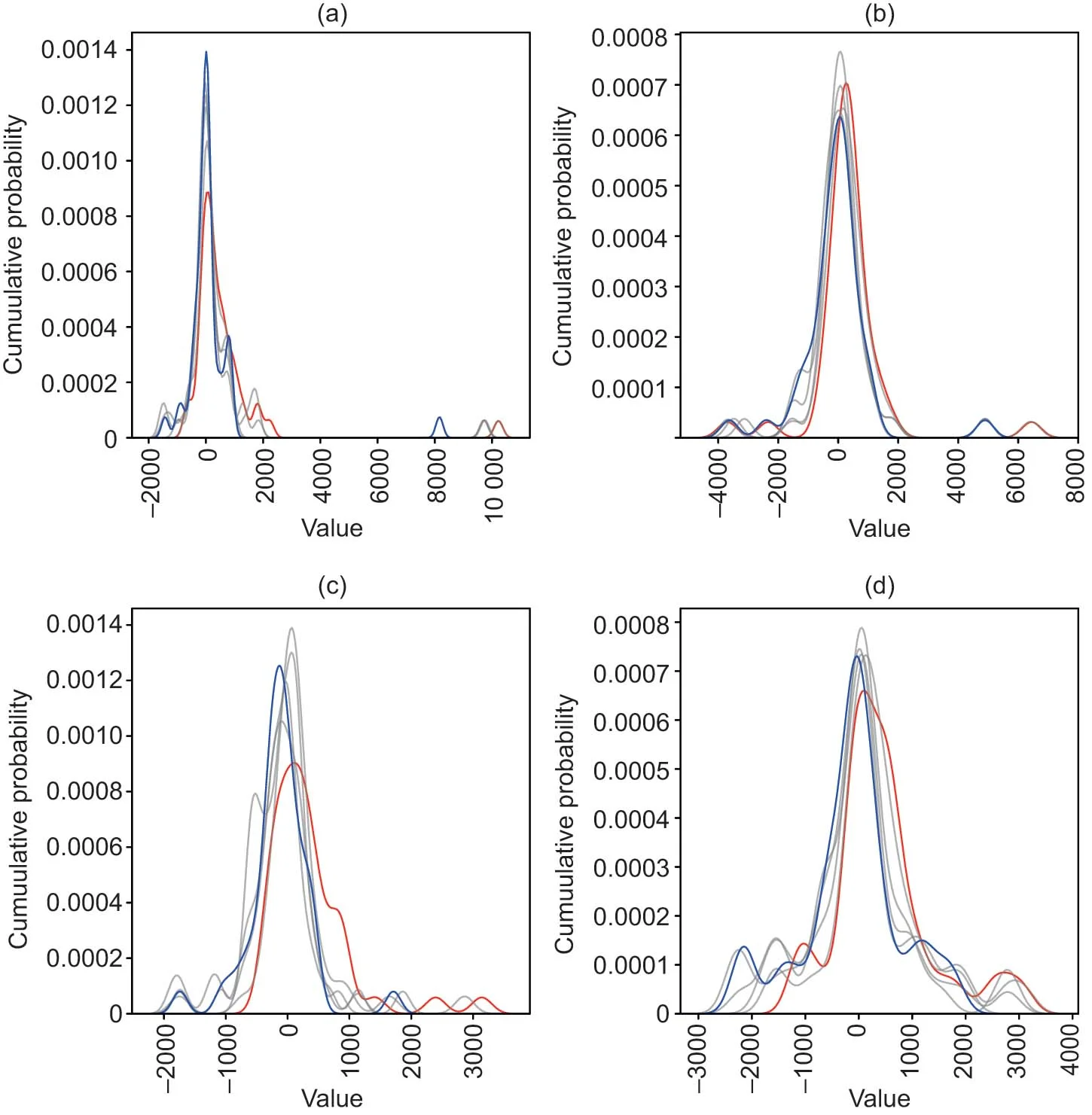

Figure 2 shows the probability density of the event strategy for tradable products for HH0 and HH1 during the summer and winter periods. Kernel density estimation is used for smoothing the probability density, since these plots have been created from a discrete data set. The red line indicates the distribution for a reaction time of 0s, and the blue line a reaction time of 50s (with gray lines showing variations in reaction times between these values). The horizontal axis displays the single-instance profitability of the strategy compared with VWAP, and the vertical axis shows the probability density of achieving such a profit or loss. The area under the curve to the right or left of the zero value (considering that slices of the plot should be weighted according to their value) can be used as an indicator of the average profitability of the strategy.

Qualitative analysis of the plots in Figure 2 shows that the closer the trade is to the event time, the smoother and more positively shifted the density (in other words, the more reliable and more profitable the trade). This is the case both in winter and summer and for both HH0 and HH1.

An alternative way of visualizing the results is to plot the cumulative distribution (Figure 3). Again, the red line indicates the distribution for a reaction time of 0s, and the blue line a reaction time of 50s (with gray lines showing variations in reaction times between these values). In the plots, the sooner that a line rises and plateaus, and therefore the further to the left it is, the less profit there is available. We can observe that in each half hour, for both summer and winter, the red (short reaction time) line is to the right of the blue (longer reaction time) line, indicating that the event strategy is more profitable with a shorter reaction time.

4.3 Profit and loss variation by lead time

Figure 4 plots the overall profit from the 90 grid events analyzed, based on different reaction times. Our results show that the event strategy becomes profitable than the baseline strategy once the overall reaction time is reduced to 30s. We also see that the profit available increases up to 20 times where the reaction time is reduced below 10s. Once the reaction time reaches above 50s, it is effectively too late to capitalize on the price changes caused by the event. In fact, losses are incurred, on average, relative to VWAP if a trade is made after this time.

4.4 Relative profit per event based on event class

Considering the average relative profit available based on the event class at a 10s reaction time (Figure 5), we see that both generator and interconnector events are, on average, profitable. However, we can see that executing the event strategy based on transmission events resulted, on average, in a small loss. This is somewhat intuitive since transmission events can often be transient in nature and often will not have a significant energy impact on the system (and consequently market price). In addition, we have only considered a relatively small sample of interconnector events and only looked at the GB market value, whereas further value is likely available when considering the associated interconnected markets and/or a more sophisticated strategy that considers the loss of interconnectors importing power to GB (where prices will typically decrease). This suggests further refinement of the event strategy to use the event classification could further increase overall profitability.

4.5 Liquidity

In terms of liquidity, our analysis showed that there were sufficient market orders available to execute the event strategy in over 90% of the half-hours analyzed (163 out of the 180). Hence, it is realistic that this strategy could be executable in practice.

5 Conclusions

We demonstrated the profitability and viability of a basic trading strategy using a trading signal sourced from real-time monitoring of grid events. Our analysis highlights the high sensitivity of potential profit to the overall reaction time, with a reduction in the overall latency of event detection and trade execution potentially increasing the profit available by up to 20 times. While the simple strategy used for this analysis focuses purely on event detection, it is clear from the results that more sophisticated approaches using event classification information could be even more profitable, and this is an area for future research. While our experiment focuses purely on the continuous intraday wholesale market, strategies that take positions in the imbalance market based on grid event signals may also warrant exploration. Given the sensitivity to overall reaction time and potential for more sophisticated strategies, our analysis highlights that a timely grid event-detection signal alongside a robust toolkit for development, assessment, implementation and refinement are critical to a profitable algo trading strategy. In line with the increasing focus on intraday trading, high-levels of volatility and increased reliance on automation in short-term power markets, we foresee increased focus, growth and opportunity in this area in the future.

Declaration of interest

The authors are employed by Reactive Technologies Limited and Brady Technologies Limited, whose technologies were used in the research presented in this paper. This study was conducted as part of the authors’ professional roles within these companies, and the findings may be used for marketing purposes. The authors affirm that the research was conducted in an objective manner, with adherence to academic standards for the integrity and accuracy of the data and its analysis. The authors report no conflicts of interest. The authors alone are responsible for the content and writing of the paper.

Acknowledgements

The authors thank Reactive Technologies Limited for the use of their grid event data from their Tradenergy solution. The authors also thank Brady Technologies Limited for the use of their algorithmic trading solution PowerDesk Edge to backtest the strategy.

References

- Ashton, P. M., Saunders, C. S., Taylor, G. A., Carter, A. M., and Bradley, M. E. (2014). Inertia estimation of the GB power system using synchrophasor measurements. IEEE Transactions on Power Systems 30(2), 701–709 (https://doi.org/10.1109/TPWRS.2014.2333776).

- Białkowski, J., Darolles, S., and Le Fol, G. (2008). Improving VWAP strategies: a dynamic volume approach. Journal of Banking and Finance 32(9), 1709–1722 (https://doi.org/10.1016/j.jbankfin.2007.09.023).

- Bowcutt, T. (2023). An introduction to grid inertia and its impact on short-term power markets. Reactive Technologies, September 26. URL: https://reactive-technologies.com/news/introduction-to-inertia.

- Bray, R., Woodman, B., and Judson, E. (2020). Future prospects for local energy markets: lessons from the Cornwall LEM. Report, University of Exeter Energy Policy Group. URL: http://hdl.handle.net/10871/124214.

- Campagna, N., Caruso, M., Castiglia, V., Di Tommaso, A. O., Miceli, R., Nevoloso, C., Pellitteri, F., Scaglione, G., Schettino, G., and Viola, F. (2022). Challenges for the goal of 100% renewable energy sources to fit the green transition. In 2022 Workshop on Blockchain for Renewables Integration (BLORIN), pp. 230–235. IEEE Press, Piscataway, NJ (https://doi.org/10.1109/BLORIN54731.2022.10028433).

- Enas, A., Kimmett, C., and Joyce, J. (2022). Inertia monitoring on renewable energy grids: quantifying modern grid stability challenges for systems with high inverter-based resource penetration using new digital technology. IEEE Electrification Magazine 10(3), 55–64 (https://doi.org/10.1109/MELE.2022.3187883).

- EPEX (2023). Monthly power trading results of March 2023. Press Release, April 5, epexspot. URL: https://bit.ly/47UP4K2.

- Hardy, J., Britton, J., and Sandys, L. (2023). Enabling decentralised energy innovation. Report, January, Sustainable Energy Futures Ltd and Innovate UK. URL: https://bit.ly/3HGdjB8

- Hosaka, N., Berry, B., and Miyazaki, S. (2019). The world’s first small power modulation injection approach for inertia estimation and demonstration in the Island Grid. In 2019 8th International Conference on Renewable Energy Research and Applications (ICRERA), pp. 722–726. IEEE Press, Piscataway, NJ (https://doi.org/10.1109/ICRERA47325.2019.8997081).

- Lavanya, L., and Swarup, K. S. (2023). Continuous real-time estimation of power system inertia using energy variations and Q-learning. IEEE Open Journal of Instrumentation and Measurement 2, 1–11 (https://doi.org/10.1109/OJIM.2023.3239777).

- Leao, B. P., Fradkin, D., Wang, Y., and Suresh, S. (2020). Big data processing for power grid event detection. In 2020 IEEE International Conference on Big Data, pp. 4128–4136. IEEE Press, Piscataway, NJ (https://doi.org/10.1109/BigData50022.2020.9378106).

- Pagnier, L., and Jacquod, P. (2018). Disturbance propagation, inertia location and slow modes in large-scale high voltage power grids. Preprint, arXiv (https://doi.org/10.48550/arXiv.1810.04982).

- Savcenko, K. (2023). Power markets boost algorithmic trading amid changing sector dynamics. S&P Global Insights, August 31. URL: https://bit.ly/4997DLs.

- Tam B., and Walker, A. (2023). Electricity market reform. POSTnote 694, UK Parliament POST (https://doi.org/10.58248/PN694).

- Tielens, P., and Van Hertem, D. (2016). The relevance of inertia in power systems. Renewable and Sustainable Energy Reviews 55, 999–1009 (https://doi.org/10.1016/j.rser.2015.11.016).

- Zhang, L., Ling, J., and Lin, M. (2022). Artificial intelligence in renewable energy: a comprehensive bibliometric analysis. Energy Reports 8, 14072–14088 (https://doi.org/10.1016/j.egyr.2022.10.347).

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net