Trading book

London-based banks face ECB Brexit power grab

Drive to supervise swaps books from Frankfurt threatens cross-border balance sheet management

FRTB could hit syndicated loans, banks fear

Accounting classification would lump assets into regulatory trading book

Basel group said to weigh changes to key FRTB test

EC and EBA officials criticise low pass rates for P&L attribution test

Q&A: EBA’s Vaillant on Basel IV, FRTB and CVA

Authority’s “key goal” in Basel talks has been to defend risk-sensitive capital framework

EBA plans reboot of FRTB’s P&L test

Authority will explore wider range of options than outlined in CRR text

Legacy booking models impede NDF clearing, banks say

Novation lag holds up clearing of forex products; some say dealers are dragging feet

Could a phase-in save FRTB?

Regional banks fear they will run out of time to implement FRTB, but a phase-in could set a welcome trend

FRTB survey: internal model approval tops list of bank fears

Two years on from its devising, chunks of the new market risk framework remain 'unworkable'

FRTB survey: risk transfer shake-up hits home

Dealers mull creation of dedicated risk transfer desks but approval process remains unclear

FRTB: banks fearful of risk transfer missteps

Short credit and equity positions held in banking book will be caught by market risk capital requirements

Taking the FRTB plunge

Banks entering chilly FRTB waters for first time facing fresh challenges

FRTB sends banks around the bend

Banks uncover hidden challenges of data, computing power and need for joined-up approach

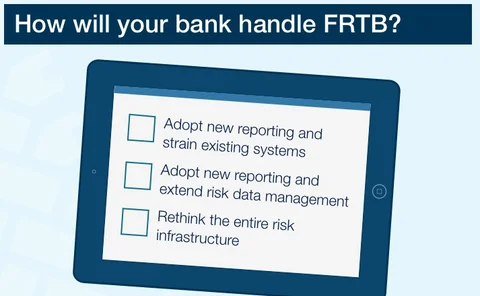

FRTB: Is your bank on track?

Content provided by IBM

Risk optimisation: the noise is the signal

Benedict Burnett, Simon O’Callaghan and Tom Hulme introduce a new method of optimising the accuracy and time taken to calculate risk for an XVA trading book. They show how to make a dynamic choice of the number of paths and time discretisation focusing…

The P&L attribution mess

FRTB model approval regime dogged by confusion and controversy

Details of vital FRTB model test still up for grabs

Banks argue valuation adjustments should be left out of the model approval process

Banks brace for assault course of FRTB implementation

Dealers face test of endurance to win model approval and avoid penal standardised charge

Revised Basel III better reflects bank risk, research finds

Study says 2013 capital rules more in line with actual risk, but can be easily gamed

Final FRTB is a game of give-and-take, say dealers

Relaxation in some areas of Basel market risk rules offset by harsher treatment in others

Fundamentally fraught: the chaotic last weeks of the FRTB

Quick fixes should have no place in a sweeping three-year reform project

Statistical spin may decide severity of trading book rules

Capital increase levied by Basel Committee could depend on use of mean versus median

Trading book QIS: residual risk is 'killing everybody'

Residual risk add-on more broadly applicable than first thought under Basel rules

UK banks won't face FRTB capital hike – BoE official

Policy expert says most trading risks already captured under Pillar 2 framework