Technology

Deutsche adds e-options

Deutsche Bank will go live with foreign exchange options on its autobahnFX trading platform in January, in response to client demand, a bank official told RiskNews ' sister publication FX Week .

Fame extends data coverage of North American gas and power markets

Data technology software provider Fame has added IntercontinentalExchange (Ice) North American gas and power indexes to its software products.

Luminary Capital Management goes live with FNX risk system

New York-based Luminary Capital Management, a global macro hedge fund, has gone live with technology provider FNX’s Sierra trade management system.

CLS impact 'neutral' for RTGS systems

The introduction of the continuous-linked settlement service (CLS) for foreign exchange has had little effect on flows and liquidity on real-time gross settlement systems (RTGS), according to the latest Bank of England (BoE) quarterly bulletin.

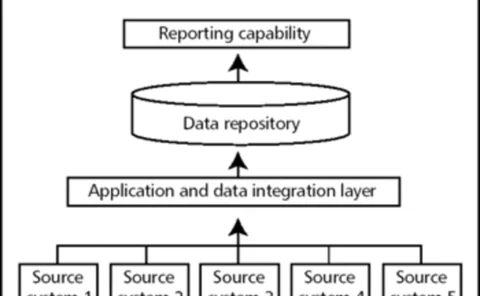

Getting it together

Data consolidation is now a vital foundation to any successful risk management implementation, as Dave Rose and Stuart Cook of The Structure Group report

Countdown to Basel II

Operational risk

BarCap launches online metals trading

Barclays Capital, the investment banking division of UK bank Barclays, has launched an online base and precious metals trading platform.

DrKW broadens its horizons

technology news

Set for growth

Comment

FNX adds real-time portfolio risk monitoring

Risk technology company FNX has added a real-time ‘treasury blotter’ to measure portfolio risk to its Sierra risk system.

Xenomorph adds pricing models to TimeScape

London-based Xenomorph has integrated pricing models for more than 150 asset classes into TimeScape, its four-month-old enterprise data management and analysis suite.

Mark-it signs up 16 credit derivatives houses

UK credit data company Mark-it Partners said today that it has signed up 16 of the largest credit derivatives houses to use its credit reference entity database, Red.

Isda and Fix join forces

The International Swaps and Derivatives Association and messaging service provider Fix Protocol have formed a joint working group to share information on the development of their respective FpML and Fix messaging standards.

Nissan Motor takes Reuters risk system

Japanese car manufacturer Nissan Motor has bought Reuters’ Kondor trade-processing risk and trade management product, Kondor+.

Kyte Group snaps up Ubitrade derivatives system

The Kyte Group, a London-based financial services group, has bought a futures and options back-office system from Ubitrade, a French trading and risk management software company.

Moody’s KMV upgrades portfolio management tool

San Francisco-based quantitative credit analytics firm, Moody’s KMV, a subsidiary of Moody's Corporation, has updated its portfolio manager tool. The upgrade will give portfolio and risk managers at banks, insurance companies and asset management firms…

PNC selects SunGard asset/liability tool

Pennsylvania-based PNC Financial Services Group (PNC) is set to implement SunGard Trading and Risk Management's BancWare Convergence product for asset/liability and balance-sheet management.

IBM rolls out SuperDerivatives for currency options

IBM has signed a multi-licence contract with London-based foreign exchange pricing company SuperDerivatives. The company will roll out the SuperDerivatives pricing system for currency options to the IT company's treasury team based in Armonk, New York.

Summit markets new porfolio product

New York-based transaction processing technology company, Summit Systems, has started to aggressively market its new portfolio processing product, Summit FT. The web-based product offers instant delivery of real-time information across a range of primary…

Derivatech wins first options risk software deal in China

Bank of China has licensed FX options software from US-based vendor Derivatech, in what marks the country’s first forex risk management software deal.

Bank of Bermuda selects Reech FastVal for derivatives valuation

The Bank of Bermuda has selected Reech FastVal for its global fund services (GFS) division, which provides fund administration services to the alternative funds industry. Reech FastVal will be used to provide independent valuation or validation of the…

Icap extends use of Kalahari software

Inter-dealer broker Icap has extended its use of pricing software company Kalahari’s derivatives pricing system ‘Kace’ to its Singapore, Hong Kong and Sydney offices.

Ontario Teachers’ Pension Plan licenses credit risk software from Kamakura

Ontario Teachers’ Pension Plan, Canada’s second largest pension fund, has licensed credit risk modelling software from Honolulu-based Kamakura.

BTM expands use of forex pricing system in Japan

The Bank of Tokyo-Mitsubishi (BTM) has extended its use of financial software company Cognotec’s online foreign exchange trading system in Japan.