Structured products

WHAT IS THIS? Structured products are investments that have multiple components. For retail investors, the most common form is a bond plus an option – these tend to be standardised, sold in small tickets and large volumes. Managing the risks of large structured products portfolios is one of the biggest challenges dealers face.

2011 Risk and Energy Risk magazines' Commodity Ranking poll

Vote now in the 2011 Commodity Ranking poll, organised by Risk and Energy Risk magazines, for your top counterparty dealers.

Skandia unveils protected Shield fund

Skandia unveils protected Shield fund

Small and mid-cap domestic equities on offer to US investors

While US equities continue to dominate the issuance, products have diversified into small and mid-cap indexes.

Domestic equities dominate index-linked issuance in US

US equities were the major theme in index-linked issuance at the end of last week, although diversification away from the S&P 500 was on offer from some providers.

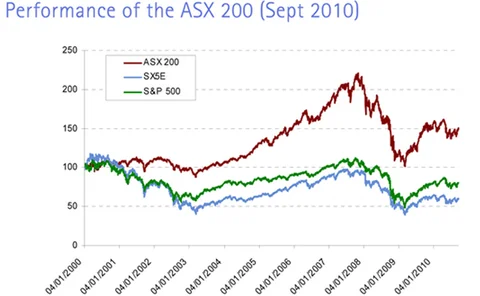

LM Investment offers access to the Australian economy

LM Investment offers access to the Australian economy

Inflation-linked structured products preferable to Linkers, says RBC WM

Inflation-linked structured products preferable to Linkers, says RBC WM

Banks could circumvent Volcker rule by gaining hedge fund exposure synthetically

Volcker rule may contain loophole that allows banks to invest in hedge funds

Emerging markets small caps perform best, says Standard & Poor's

Small-cap emerging markets outperform large-cap markets

Lifemark investors low down in pecking order for payouts

Lifemark investors low down in pecking order for payouts

Swiss Scoach exchange sees October records

Swiss investors look for better yields as listed yield enhancement products reach their highest level this year

Citi launches 10-year Vix ETNs in the US

Citi Funding is offering a hedge against the negative correlation between volatility and equity markets as well as an option to take a view on volatility.

Ellen Davis: Bringing back the Belgian dentist

New EU-wide regulations for retail investment products are needed to lure investors back into European securities, according to speakers at the ICFR conference in Amsterdam

Barclays Stockbrokers launches emerging markets certificate

Barclays Stockbrokers has launched an autocall certificate based on the MSCI Emerging Markets index.

UK Wrap: Plan managers diversify away from FTSE

The products this fortnight offered an exciting variety of commodities, emerging markets, the Eurostoxx index, S&P index and the FTSE index

Barclays makes its debut in the Italian ETN market

Barclays has listed its first iPath ETN in Italy, hoping to add to the success of its volatility-linked ETNs

BarCap builds on volatility ETN with new listings

Barclays Capital has listed a second volatility iPath ETN on the London Stock Exchange, along with a first listing in Milan

Olcott joins Citi as head of US retail structured products sales

Gage Olcott has joined Citi in the US to help build up its third-party distribution efforts

Tenors stretched as banks struggle to structure products in current environment

While volumes have been healthy in the US market this week, maturity dates are being extended, but there is still innovation to be seen

EU prepares to go the direct route on structured products law implementation

The introduction of several new European Union laws covering financial investments could prohibit sales of some products and push up costs

Europe Awards 2010

Europe Awards 2010

Equity derivatives house

Structured Products Europe Awards 2010

Editorial: Kicking against the Prips

Editorial: Kicking against the Prips

House of the year

Structured Products Europe Awards 2010