Standardised approach to counterparty credit risk (SA-CCR)

SA-CCR may need more fundamental fixes

Quants propose tweaks to improve Basel counterparty credit risk framework

Revisiting SA-CCR

Berrahoui, Islah and Kenyon propose an alternative to SA-CCR

Under SA-CCR, Nomura leverage exposure drops over ¥7 trillion

Methodology switch sends leverage ratio soaring to 5.04%

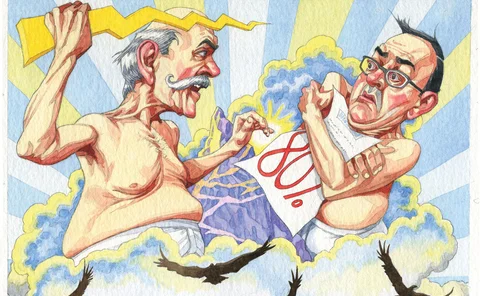

US swaps end-users cry foul over SA-CCR punch

Capital on non-margined trades jumps 90%, and energy firms face double hit

US version of SA-CCR could hurt settled-to-market swaps

Capital requirements on a client’s hedged options portfolio could increase by 1,100%

SA-CCR would dent US dealers’ leverage ratios – trade bodies

Goldman Sachs, Morgan Stanley and JP Morgan would likely see the largest leverage exposure spikes

Capital requirements for options are ‘crazy’ – DRW

Wilson says current rules penalise options, but SA-CCR does not go far enough to fix the problem

Mizuho reveals $270m CVA loss

Further losses may be reported as bank refines its methodology, sources say

Non-netting status denies capital boost for Chinese banks

Reliable close-out netting could cut China’s SA-CCR capital requirements by around 20%

For US banks, billions in regulatory manna

The unwind should help mid-tier banks, but the G-Sib impact is a complex balancing act

Banks scent margin offset in US SA-CCR proposal

US agencies seek comment on whether IM should be recognised in leverage ratio calculations

Basel Committee names and shames regulatory laggards

Mexico, China, and US yet to implement key rule changes

Basel to propose IM offset in leverage ratio

Four sources say draft will make concession; it could also revive EU-US segregation drama

Brexit OTC mutation, chaperones and SA-CCR

The week on Risk.net, October 6–12, 2018

SA-CCR proposal imminent, Fed adviser says

NSFR could also be finalised before year-end; final stress capital buffer rule expected in early 2019

Exchanges warn on clearing concentration

Clearing houses urge margin offset in leverage ratio, adoption of SA-CCR and recalibration of NSFR

Fed, Goldman: wide use of SA-CCR creates problems

Isda AGM: Fed plans quick implementation, while Goldman urges caution on extending use

Senate bill will not hurt big bank oversight – Powell

Fed chair says raising of Sifi threshold will not affect application of enhanced standards

CVA dismay: final Basel rules disappoint dealers

Minor tweaks don’t make up for removal of internal modelling, say banks

Capital rules may be too risk-sensitive, Basel fears

Complexity is slowing roll-out of standards, says Basel Committee deputy

Repeal CEM; reform SA-CCR

Capital framework hurts clearing resilience, Citi execs argue

Focus on Basel output floor calibration misses the point

Until all the final standardised approaches are known, the floor has little meaning

Basel capital floor faces credit risk eclipse

Impact of capital floor depends on new credit risk rules and changes to treatment of provisions

EU regulator dampens SA-CCR reform hopes

Isda AGM: EBA acknowledges approach’s shortcomings, but warns Basel is not reconsidering