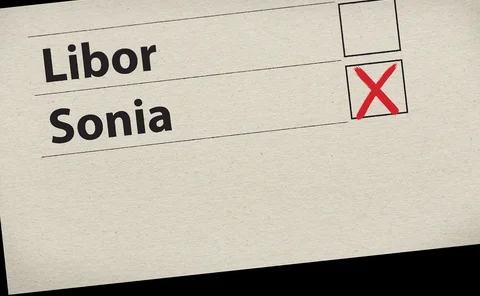

Sonia

Sonia term rate contenders tested by market mayhem

Regulator-proposed quote approach falters as dealers pull swap prices from screens

Lloyds and Riverside rehitch revolving loan to Sonia

£100m Sonia facility overcame late operational hurdles to be among the first done since the onset of coronavirus

Libor webinar playback: spotlight on bonds

Panellists from Lloyds, RBC Capital Markets and TD Securities discuss efforts to switch to new lending benchmarks

Swaps benchmark vanishes as traders flee firm price venues

Dollar Ice swap rate fails to publish in March rout; patchy Sonia Clob prices could delay term rates

Pandemic threatens Libor transition plans

Resources diverted to Covid-19 response, as RFR-Libor basis spikes on stress

Sonia swaps surge not mirrored by futures

Popularity of short sterling futures takes shine off Sonia’s RFR succession

BoE’s new Sonia index gets a thumbs-up from issuers

Calculating coupons based on compounded Sonia was “a real nightmare” for some

Sonia’s share of sterling swaps tipped to hit 80% by year-end

Ahead of Monday’s convention switch, dealers already view Sonia as the primary sterling rate

FCA: sign up to fallback protocol or face ‘serious questions’

UK regulator urges derivatives users to accept Isda swap fallbacks to ensure compliance with benchmark law

BoE to publish ‘golden source’ compounded Sonia index in July

UK to align with US in effort eliminate interest calculation mismatches and turbo-charge adoption

Synthetic Libor faces legal obstacles

EU benchmark rules may thwart ‘tough legacy’ fix, reviving calls for blanket legislation

‘Rounding errors’ prompt EBRD to break with Sonia FRN norms

Index-friendly coupon structure touted as a template for future issuance in the UK market

Goldman, JPM kick off SOFR swaptions

US dealers spearhead non-linear trading but patchy liquidity weighs on vol market ambitions

FCA dismisses Libor credit component concerns

UK regulator bemused by distress raised by US regional banks to Fed

Libor limbo: loan market fallback language upends lenders

Banks seek to replace painful fallback language in loan docs and avoid a cost-of-funds contingency

Isda plans February rerun of Libor pre-death trigger poll

Lack of consensus would add pre-cessation option to post-cessation protocol for bilateral swaps

Libor replacement jumble may hike hedging costs

Use of term rates and credit adjustments will create new basis risks that could be costly to hedge

Regulators urge buy-side action on Libor shift

ARRC set to release ‘checklist’ for buy-side firms, while FCA assesses exposures

LCH targets hardwired pre-cessation triggers

Proposal aims to align transfer pricing for cleared and bilateral markets in the event of split on ‘zombie Libor’ triggers

New pre-cessation poll likely as FCA quells zombie Libor fears

Minimal non-representative lifespan opens door for rerun of Isda trigger consultation

Signing the Libor fallback protocol: a cautionary tale

As Orwell’s Room 101 beckons for Libor publication, muRisQ Advisory’s Marc Henrard warns of a potential pitfall in the fallback protocol

Compounding, venue disruptors and the Fed’s stress buffer

The week on Risk.net, January 11–17, 2020

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades