Sanctions

Russian loan liquidation lifts RBI’s risk density

Cash parked at sanctioned central bank carries higher capital requirements than original loans

Watchlist and adverse media monitoring solutions 2024: market update and vendor landscape

This Chartis report updates Watchlist monitoring solutions 2022 and focuses on solutions for sanctions (name and transaction) screening and monitoring adverse media and its related elements

Geopolitics is harsh terrain for FMIs

Idiosyncratic nature of disputes and flare-ups leaves exchange and infrastructure operators blending metrics with guesswork

Loss of ruble volatility waiver costs UniCredit €2.2bn in RWAs

Lender forced to capitalise FX risk from Russian operations after ECB withdraws key exemption

Op risk data: Wells Fargo whacked for Wachovia lapse, and a Ponzi slap

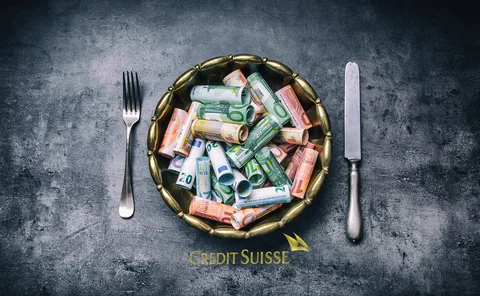

Also: Long and winding road to the end of Credit Suisse; Swedbank IT fails. Data by ORX News

ING’s Russia loans sour five times faster than UniCredit’s

Risk density of Dutch bank’s Russia portfolio soars from 54% to 229% during 2022

Top 10 operational risks: Focus on regulatory risk

Tougher regulatory enforcement, new consumer rules and rise of ESG are ringing alarm bells

Top 10 operational risks for 2023

The biggest op risks for the year ahead, as chosen by senior industry practitioners

Navigating the volatility and complexity of commodity markets

Commodity markets have experienced significant challenges since the Covid-19 pandemic, the conflict in Ukraine and the subsequent sanctions imposed on Russia. These unprecedented events have caused fluctuations in supply and demand, disrupted global…

Clearing house of the year: LCH

Risk Awards 2023: A member default and a spike in UK rates were handled with aplomb, while cleared volumes rose

What happens when a bank drops off the systemic risk radar?

Russia’s Sberbank skipped this year’s G-Sib assessment. But just because a bank is invisible doesn’t mean it no longer poses a risk

China congress brings new risks to foreign bank JVs

New political risks add to existing challenges for fully controlled ventures in the country

Op risk data: Dodgy tax practices cost Credit Suisse €240m

Also: Binance blockchain hack; ING’s Polish AML fail. Data by ORX News

Danske gets Pillar 2 reprieve through $2bn AML provision

Quantifying the hit from Estonian branch investigations earned the bank a 75% cut in add-ons in place since 2018

Norway oil fund marks down Russia stocks by 87%

Country’s sovereign wealth fund moved equity holdings to lowest level of fair-value hierarchy

Netting uncertainty inflates Citi’s Russia exposure

Russia made up 1.2% of the bank’s top 25 exposures by country, up from 0.8% in Q1

Erste sees provisions rising fourfold in gas embargo scenario

Vienna-based bank wargamed for an unlikely but devastating halt to Russian gas shipments

GFMA proposes disruption settlement framework for FX

Russian ruble close-out pain triggers calls for voluntary multilateral pricing framework

UniCredit rebounds on ruble rally, Russia RWA cut

Strengthening profile of Russian operations added 62bp to the bank’s CET1 ratio in Q2

US deposits from Russia hit record $43.5bn after invasion

Rush to stash cash followed walling-off of Russian financial system by sanctions

Russian corporates stashed cash at EU banks in Q1

Deposits from non-financial corporations increased 36%, while Moscow’s central bank cut balances by 28%