Residential mortgages

Mortgages, auto loans find a home in new EU securitisations

Esma listed 23 public STS securitisations as of July 1

Stress test projected loan losses fall $18bn

Credit card loss rates account for 36.3% of total loan losses under severely adverse scenario

Metro Bank execs under scrutiny after loan probe snafu

Lender could see capital buffer rise after admitting regulator, not bank, discovered errors

US Bancorp cuts $87 million of soured loans

Ratio of toxic assets to total loans fall 19% quarter-to-quarter

Model revamp hikes UBS credit RWAs

Calculation tweaks made to scrap higher regulatory RWA multipliers

UniCredit sheds €10.5 billion in toxic loans

Net write-downs on all loans fell to €496 million in the quarter, down from €835 million in December, an improvement of 40%, as a result of improved asset quality

Westpac's capital charge rises as securitisation rule bites

Securitisation RWAs jump from A$1.4 billion under new standard

NAB model change boosts mortgage RWAs

Residential mortgage RWAs leap A$10.6 billion

Top 10 op risks 2018: mis-selling

Speculation rife among survey participants over ‘the next PPI’

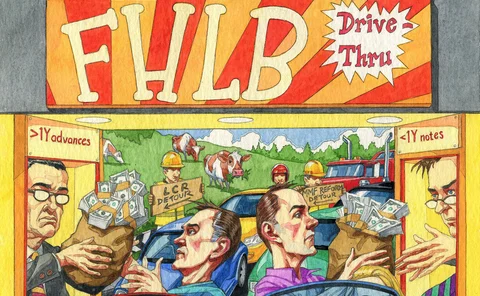

Soaring Fed Home Loan Bank borrowings spark systemic risk fears

Parallels drawn with Fannie and Freddie as commercial bank borrowing from FHLBs nears $500bn

Canadian CROs play down threat of mortgage exposure

Burgeoning loan portfolios no cause for concern despite Moody’s downgrades, risk chiefs claim

Bank deal of the year: SG CIB

Risk Awards 2017: French bank found way to finance – and recycle – Czech mortgage bonds

Regulatory miasma makes life difficult for Ocwen CRO

Op risk veteran Marcelo Cruz says firm faces “absurd” quantity of rules in US mortgage market

Life firms look to build on mortgage lending success

Dutch approach could be copied elsewhere in Europe

Insurers weigh home-loan investment as efficient source of yield

Capital charge for residential mortgages under Solvency II makes buying loan portfolios more attractive, say bankers

Hedge funds, leverage and mortgages: why Fannie and Freddie's new deals worry some experts

Hedge funds have been keen buyers of the new mortgage risk-sharing deals issued by Fannie Mae and Freddie Mac, but as spreads have tightened, worries about leverage have grown. Some now argue mortgage finance requires a more stable source of capital. By…

Can ECB draw a line under European banking fears?

Before the European Central Bank takes on its new supervisory role, a planned asset-quality review should ensure it is not walking into trouble. That’s if the process is thorough, of course, and untainted by political pressure – sceptics say that will be…

Hedge funds expect more alpha in mortgage trades

Despite a spectacular run-up in prices since 2010, US residential mortgages continue to offer strong opportunities for hedge funds. Investors should continue to see gains throughout 2013

Swedish banks braced for home loan capital hike

A weighty issue

Regulatory differences could be behind RWA inconsistency, report suggests

Initial findings of a review led by the European Banking Federation suggests differences in regulatory regimes could be behind a divergence in RWA numbers

Credible capital: regulators prepare to tackle RWA divergence

Credible capital

The modification mistake: Joseph Mason column

The modification mistake: Joseph Mason column

New York Fed RMBS sales go smoothly

Auctions of AIG legacy portfolio delivering a solid result for the Fed

Lawyer warns of securities fraud lawsuits over foreclosure crisis

Bank of America faces lawsuit over charges of witholding information on failings, and others could follow