Quantitative finance

WHAT IS THIS? Quantitative finance is a field of applied mathematics concerned with financial markets. In banking, it spread from the pricing of derivatives to the modelling of credit, market and operational risks. Today’s quantitative analysts are scattered across a range of functions, from risk management and model validation, to data science, algorithmic trading and regulatory compliance.

Quant Guide 2019: Imperial College London

London, UK

Quant Guide 2019: Fordham University

Gabelli School of Business, New York City, New York, US

Quant Guide 2019: EISTI

Cergy-Pontoise, France

Quant Guide 2019: Paris-Diderot University

Paris, France

Quant Guide 2019: Carnegie Mellon University

Tepper School of Business, Pittsburgh, Pennsylvania, US

Quant Guide 2019: Massachusetts Institute of Technology

Sloan School of Management, Cambridge, US

Quant Guide 2019: University of St Gallen

St Gallen, Switzerland

Quant Guide 2019: Baruch College, City University of New York

New York City, New York, US

Quant Guide 2019: Boston University

Questrom School of Business, Boston, Massachusetts, US

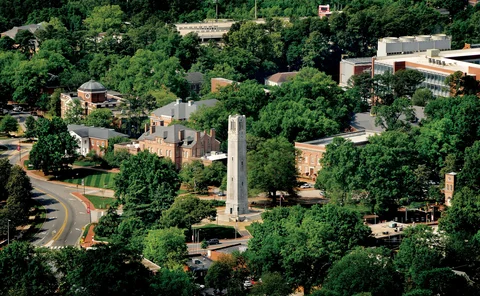

Quant Guide 2019: Princeton University

Bendheim Center for Finance, Princeton, New Jersey, US

Quant Guide 2019: University of Chicago

Chicago, Illinois, US

Quant Guide 2019: University of Amsterdam

Amsterdam, Netherlands

Quant Guide 2019: University College London

London, UK

Quant Guide 2019: King’s College London

London, UK

Quant Guide 2019: University of Oxford

Oxford, UK

Quant Guide 2019: University of Waterloo

Waterloo, Ontario, Canada

Quant Guide 2019: Erasmus University Rotterdam

Rotterdam, Netherlands

Quant Guide 2019: University of Florence

Florence, Italy

Quant Guide 2019: NYU Tandon

Tandon School of Engineering, New York City, New York, US

Quant Guide 2019: City, University of London

Bayes Business School (formerly Cass Business School), London, UK

Quant Finance Master’s Guide 2019

Risk.net’s guide to the world’s leading quant master’s programmes, featuring a ranking of the top 15 schools

Princeton tops inaugural Risk.net quant master’s ranking

Course sees off competition from Berkeley’s Haas and three New York schools