Quantitative finance

WHAT IS THIS? Quantitative finance is a field of applied mathematics concerned with financial markets. In banking, it spread from the pricing of derivatives to the modelling of credit, market and operational risks. Today’s quantitative analysts are scattered across a range of functions, from risk management and model validation, to data science, algorithmic trading and regulatory compliance.

Quant Guide 2020: Fordham University

New York City, US

Quant Guide 2020: New York University (Tandon School of Engineering)

New York City, US

Quant Guide 2020: Baruch College, City University of New York

New York City, US

Quant Guide 2020: Boston University (Questrom School of Business)

Boston, Massachusetts, US

Quant Guide 2020: University of Minnesota

Minneapolis, US

Quant Guide 2020: KU Leuven

Leuven, Belgium

Quant Guide 2020: Columbia University

New York City, US

Quant Finance Master’s Guide 2020

Risk.net’s guide to the world’s leading quant master’s programmes, with the top 25 schools ranked

Princeton tops Risk.net Quant Guide for second year running

UK’s Imperial ranks sixth; first university from mainland China features

Neuberger Berman gets its Sherlock on

Asset manager deploys quant-cum-sleuth to sniff out portfolio risk

Stock-picking finds unlikely champion in ex-Winton CIO

Matthew Beddall’s Havelock restyles value investing for the big data age

Rising star in quant finance: Blanka Horvath, Aitor Muguruza and Mehdi Tomas

Risk Awards 2020: New machine learning techniques bring ‘rough volatility’ models to life

When the data’s not there, expert-led models could help

Missing data is a problem. Expert elicitation taps the knowledge of many, say consultants

Sandbar's focus on idiosyncratic factors sets it apart from its peers in equity market‑neutral

With investors sometimes struggling to find hedge funds that deliver uncorrelated, consistent returns, Sandbar Asset Management stands out from its peers. Its success in running an equity market-neutral strategy is a reflection of its founder and chief…

The theoretical foundations of XVAs

Bloomberg analyses the theoretical basis of XVAs, focusing on the works and findings of its head of quantitative XVA analytics, Mats Kjaer, who emphasises the role of the capital valuation adjustment as a major driver of derivatives trading profitability…

ESG investing: It’s not just great to be good

Investing according to environmental, social and governance (ESG) criteria can be done in various ways, with continuing development of filters and ways of analysing companies. As the market in ESG indexes and investments linked to sustainability matures,…

Looking forward to backward‑looking rates

Interbank offered rates are critical in the world of contracts and derivatives, acting as reference rates in millions of financial contracts and with a total market exposure in the hundreds of trillions of dollars. Bloomberg explores why offering…

Derivatives house of the year, Japan: BNP Paribas

Asia Risk Awards 2019

Structured products – The ART of risk transfer

Exploring the risk thrown up by autocallables has created a new family of structured products, offering diversification to investors while allowing their manufacturers room to extend their portfolios, writes Manvir Nijhar, co-head of equities and equity…

Goldman improves execution ‘by 50%’ with new algos

Bank uses neural networks and other AI tools to cut slippage in stock trading

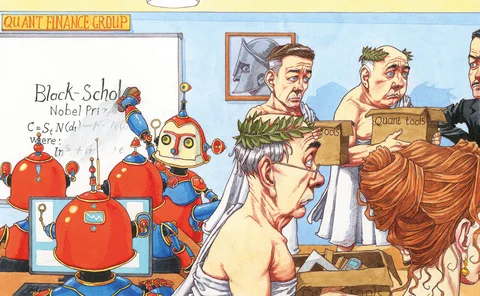

The rise of the robot quant

The latest big idea in machine learning is to automate the drudge work in model-building for quants

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging

Fishing for collateral with neural nets

SocGen quant uses deep learning technique to optimise collateral substitution

Optimal posting of collateral with recurrent neural networks

Pierre Henry-Labordère applies neural networks to a control problem approach for managing collateral