Quantitative analysis

Monthly snapshot

market data

Triple-B tie-up

technical

Detecting market abuse

Financial regulators need a way to detect market abuse in real time. Marcello Minenna has developed such a procedure that can detect, for each quoted stock and on a daily basis, the presence of market abuse phenomena by means of a set of tripwires that…

Maximum likelihood estimate of default correlations

Estimating asset correlations is difficult in practice since there is little available data andmany parameters have to be found. Paul Demey, Jean-Frédéric Jouanin, Céline Roget andThierry Roncalli present a tractable version of the multi-factor Merton…

Mixed default modelling

Structural and reduced-form models are two well-established approaches to modelling afirm’s default risk. Here, Li Chen, Damir Filipovic/ and Vincent Poor develop a new default riskmodelling strategy based on combining these two frameworks in order to…

Incorporating policyholder expectations into ALM

European life insurers have recently improved their asset/liability management (ALM) skills.However, those efforts have been limited to the matching of guaranteed policyholder benefits.While bringing considerable insight, they also leave management with…

Quant analysis by StructuredRetailProducts.com

Quant analysis

Premier Fund Managers

Quant analysis by StructuredRetailProducts.com

Caisse d’Epargne

Quant analysis by StructuredRetailProducts.com

Scottish Widows

Quant analysis by StructuredRetailProducts.com

Poste Italiane

Quant analysis by StructuredRetailProducts.com

Monthly snapshot

market data

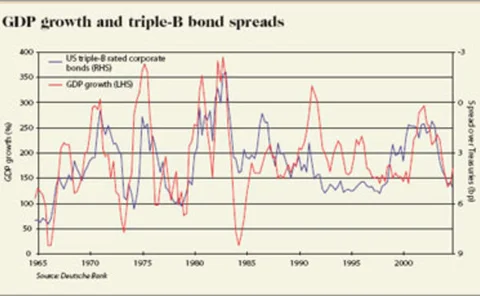

Default lines

market graphics

Counting on foreign cash

foreign investment

In the core of correlation

The single-factor Gaussian copula model has become a benchmark for the pricing and risk management of basket credit derivatives and synthetic CDO tranches. However, recent months have seen the development of a market for tranched synthetic indexes,…

Detecting market abuse

Financial regulators need a way to detect market abuse in real time. Marcello Minenna has developed such a procedure that can detect, for each quoted stock and on a daily basis, the presence of market abuse phenomena by means of a set of tripwires that…

Maximum drawdown

The maximum loss from a market peak to a market nadir, commonly called the maximum drawdown (MDD), measures how sustained one’s losses can be. Malik Magdon-Ismail and Amir Atiya present analytical results relating the MDD to the mean return and the…

HSBC

Quant analysis by Arete Consulting

CIC

Quant analysis by Arete Consulting

Nvesta

Quant analysis by Arete Consulting

CNP

Quant analysis by Arete Consulting

Smile dynamics

Traditionally, smile models have been assessed according to how well they fit market option prices across strikes and maturities. However, the pricing of most recent exotic structures, such as reverse cliquets or Napoleons, is more dependent on the…

Correlating market models

While swaption prices theoretically contain information on interest rate correlation, Bruce Choy, Tim Dun and Erik Schlögl argue that, for any practical purpose, this information cannot be extracted. Care must therefore be taken when pricing correlation…