Quant investing

You have reached the ‘Quant investing’ Topic page. You might prefer to instead go to the followable ‘Quant investing’ Category page. Please click here.

Adia hires three to join its growing supergroup of quants

Alexandre Antonov, Adil Reghai and Andrey Itkin join unit at world’s third-largest wealth fund

Geopolitical risk models not ‘rigorous’ enough, says quant

Joseph Simonian believes game theory and reinforcement learning could improve matters

Correlation ‘is not causation’ for rates and value stocks

Some quants remain unconvinced by the ‘great rotation’ away from growth

Hedging inflation may never have been trickier

Effective hedging depends on what’s causing prices to rise

Ukraine conflict reminds quants that operations matter

Quants cannot ignore real-world frictions such as sanctions and market closures

Surging Vix would turbocharge Blackstone Credit strategy

Unique high-yield systematic strategy has outperformed equivalent ETF by 18% over five years

Clunky crypto markets serve quants well – can it continue?

Poor price discovery presents opportunities for systematic traders in super-trending markets

In fake data, quants see a fix for backtesting

Traditionally quants have learnt to pick data apart. Soon they might spend more time making it up

Union beckons for the three quant tribes

Studies may be deferred, but future for grads is bright, argues UBS’s Gordon Lee

Inconsistent ESG scores force USS to make its own decisions

Pension fund needs ESG alternatives to bonds to help close its funding deficit

Quants tout alternative carry trades for the ‘new normal’

Low rates and flatlining yield curves leave investors seeking carry in swaps and swaptions

Quants try to explain why value works better in credit

Equity value may be in the doldrums, but the strategy works in credit – investors think they know why

The scientists probing the human mind for an investing edge

Recent advances in behavioural finance could give rise to new quant models and strategies

Firms hone use of new data to pick Covid-19’s winners

Investment managers are starting to use alternative data to assess the pandemic’s effect on individual stocks

Quants puzzle over how to handle negative oil prices

Firms are choosing to cut ‘outlier’ prices from data or to rely more on fundamental inputs

Covid-19 tumult is testing AI fund returns

Some ML strategies have coped well, but others began to struggle as panic mounted

What quants can learn from the Covid crisis

More nowcasting, less backtesting, and strategies that adapt to new regimes: a manifesto from Lipton and López de Prado

Caveat pre-emptor: Man ESG chief talks snubbed markets

Robert Furdak is sparking discussions about responsible trend following in unsustainable stocks

Fuzzy data stalls ESG alpha hunt

Quants searching for ESG signals have reached very different conclusions. Mostly they blame the data

The age of ethical investing, but can quants cope?

Systematic managers grapple with ESG demands of clients

Systematic investing, the value factor and Hong Kong swap rates

The week on Risk.net, October 12–18, 2019

Value: ‘Trade of the decade,’ says QMA

Quant firm predicts big revival for out-of-favour strategy

Pimco deploys neural net model in agency bonds

Old models for $7 trillion mortgage market overstate risk in some cases, asset manager says

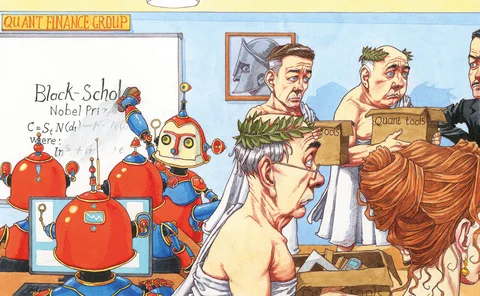

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging