Probability of default (PD)

Credit data: falling default risk for China’s banks

Economic data may be relatively gloomy, but default probabilities for lenders fell sharply last year

Default risks in peripheral eurozone inch up

Italian corporate PD estimates up to 9.12%

Tools to blunt credit risk popular at EU banks. But why?

Just 1% to 5% of exposures covered by credit risk mitigants

Pooled resources offer way to keep credit models afloat

Supervisors drive banks to seek more corporate default data and cost-effective model improvements

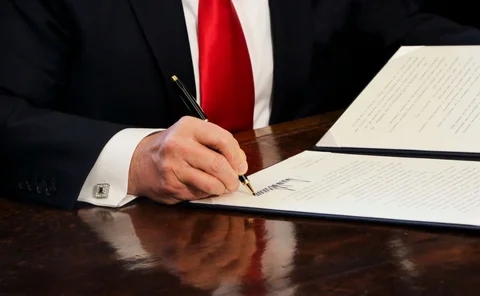

Credit data: how US industries have fared under Trump

At the halfway point in the administration, time for a credit check, writes David Carruthers

A fifty-year retrospective on credit risk models, the Altman Z-score family of models and their applications to financial markets and managerial strategies

This paper reflects upon the evolution of the Altman family of bankruptcy prediction models, as well as their extensions and multiple applications in financial markets and managerial decision making.

European credit model outputs vary wildly

Risk densities range widely and out-of-sync with average probabilities of default

Deutsche Bank's risky corporate loan pile towers over peers

German lender has one-quarter of all high-risk corporate loans reported by EU big banks

Credit data: doom loop depends on sovereign strength

Analysis of 59 countries shows bank and sovereign credit are most likely to be correlated in lower-rated countries

Improved credit loss estimates proposed for IFRS 9

New smoothing technique claims to overcome flaws in risk rating scales

EU banks slash default risk estimates for corporates by 30%

Probabilities of default fall on average across 39 countries

Credit data: Trump tax cuts have not hurt US states

Tax package is double-edged sword for US states, but credit has strengthened over past year

Credit data: default risk still growing for Italy’s banks

Despite a drop in the bad loan ratio, default estimates continue to rise, writes David Carruthers of Credit Benchmark

Implementing Basel III – the view from Europe

EU approach to new credit risk framework must recognise local market structures, say banking experts

Lenders reveal struggles over IFRS 9 roll-out

Size of task caught some banks unawares, leading to botched home-grown systems or data problems

JP Morgan counterparty credit risk grows

Risk-weighted assets consumed by least-risky counterparties decline from 57% to 36% in two years

Smoothing algorithms by constrained maximum likelihood: methodologies and implementations for Comprehensive Capital Analysis and Review stress testing and International Financial Reporting Standard 9 expected credit loss estimation

In this paper, the author proposes smoothing algorithms that are based on constrained maximum likelihood for rating-level PD and for rating migration probability.

Credit data: firms with fewer well-paid women are riskier

Gender pay gap disclosures could be a proxy for credit risk, writes David Carruthers of Credit Benchmark

Credit data: UK retail sector’s woes continue

High street fails to get over Christmas slump; elsewhere, global PDs remain in flux, writes David Carruthers of Credit Benchmark

Underperforming performance measures? A review of measures for loss given default models

This paper reviews the ways of measuring the performance of LGD models that have been previously used in the literature and also suggests some new measures.

Credit data: a tough year for South African financials

Default risk rose steadily for 36 firms during Zuma’s final months of rule, writes Credit Benchmark’s David Carruthers

Nonlinear relationships in a logistic model of default for a high-default installment portfolio

This paper uses data on consumer credit along with generalized additive models to analyze nonlinear relationships and their effect on predicting the probability of default in the context of consumer credit scoring.

Credit data: the Trump effect on PDs

The war on coal is over, according to the US president – and the effect can be seen in banks' default estimates