Probability of default (PD)

Project finance risk methodologies

Federico Tacchetto, senior manager at Prometeia, describes how to calculate risk parameters for project finance exposures. Based on a simulation approach of the cashflows, it is assessed whether the generated net revenue will be sufficient to repay the…

How to model potential exposure, post-Archegos

BofA quant’s model considers the correlation between market shocks and counterparty defaults

Modeling credit risk in the presence of central bank and government intervention

In this paper a simple approach for including central bank and government intervention in credit models is developed and illustrated using the Fed’s data for the CCAR 2021 stress test.

Model clampdown costs NatWest 157bp of CET1 ratio

Measures to remedy internal model deficiencies added £14.8 billion RWAs overnight

The loss optimization of loan recovery decision times using forecast cashflows

In this paper, a theoretical method is empirically illustrated in finding the best time to forsake a loan such that the overall credit loss is minimized.

A structural credit risk model based on purchase order information

This paper proposes a credit risk model based on purchase order information to address the deficiencies of monitoring methods that use only financial statements.

Bank-sourced transition matrixes: are banks’ internal credit risk estimates Markovian?

This study explores banks’ internal credit risk estimates and the associated banksourced transition matrixes.

Calibration of rating grades to point-in-time and through-the-cycle levels of probability of default

The paper argues for the need for and importance of the dual calibration of a probability of default (PD) model (ie, calibration to both point-in-time and through-the-cycle PD levels.)

Backtesting of a probability of default model in the point-in-time–through-the-cycle context

This paper presents a backtesting framework for a probability of default model, assuming that the latter is calibrated to both point-in-time and through-the-cycle levels.

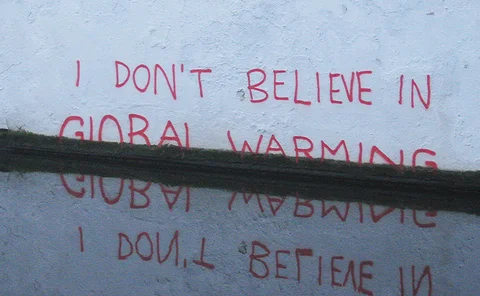

Climate risk: the writing is on the wall

For the EU financial sector, climate risk is inescapable, but it could be tamed

Weather, or not: is climate risk just part of credit risk?

Practitioners divided on whether climate risk can fit into existing credit risk weights

EC expected to apply output floor at group level only

‘Parallel stacks’ proposal unlikely to appear in first draft of CRR III, due next month

Default risk set to rise from climate inaction – ECB

‘Hothouse world’ scenario could see average probability of default increase significantly more than under both orderly or belated transition

Validation nightmare: the slotting approach under International Financial Reporting Standard 9

This paper makes an important contribution to the practice of validation by focusing on an under-researched area of the slotting approach to real estate specialized lending under the International Financial Reporting Standard 9 (IFRS 9) framework.

After bruising EU model review, banks ask: ‘Why bother?’

Post-Trim changes erode capital savings from internal models while raising their running costs

EU banks’ credit risk estimates stabilised at year-end

Weighted average corporate borrower PD across countries climbed to 2.15%

At systemic US banks, corporate default risk ebbed in Q4

Median PD of corporate portfolios down to 1.6% from 1.73%

A framework to analyze the financial effects of climate change

Starting with an expert assessment of the climate risk factors over a specified horizon, then moving to a description of the expected number of climate events and the severity of the losses if an event occurs, the authors describe a framework to analyze…

Japanese generally accepted accounting principles – CVA accounting

In April 2021, Japanese generally accepted accounting principles (JGAAP) will incorporate credit valuation adjustment (CVA) and debt valuation adjustment pricing for derivatives portfolios. With several challenges left to overcome and the deadline…

Citi’s counterparty credit risk edged higher in Q3

Risk-weighted assets for OTC derivatives, repo, margin loans jump 11%

IFRS 9 product of the year: AxiomSL

Asia Risk Technology Awards 2020

Covid policy risk hangs over bank stress tests

Banks and regulators are second-guessing the policy response to new outbreaks

Corporate default risk modeling under distressed economic and financial conditions in a developing economy

The authors create stepwise logistic regression models to predict the probability of default for private nonfinancial firms under distressed financial and economic conditions in a developing economy. Their main aim is to identify and interpret the…

EU banks’ credit risk estimates deteriorated in Q2

Weighted average corporate borrower PD across countries climbed to 2.04%