Pension funds

36 South opens volatility hedge fund for US pensions

US pension funds are attracted by the low correlation to mainstream asset classes offered by 36 South's flagship fund, says its CIO. He says European funds should not ignore the US market

Defined benefit pension strategy with stochastic volatility

Defined benefit pension strategy with stochastic volatility

Insurers eye longevity risk trades with Canadian and Dutch pension schemes

Influx of new swap intermediaries and improved risk modelling to spur expansion

DOL paves way for US pension funds to clear swaps

FCMs and pension funds welcome long-awaited Department of Labour advisory opinion

Huge RPI swaps move catches market flat-footed

Some dealers said to have suffered losses after surprise decision to leave RPI methodology unchanged

Collateral clawback fears leave US pension funds unable to clear

Banks and pension plans are waiting for the US Department of Labor to clarify whether initial margin counts as plan assets

The unintended consequences of the UFR

Annuity dawns

Sponsored statement: Standard Chartered

Asia’s local capital markets stand on the verge of a boom

BNY Mellon fails to have securities lending lawsuit dismissed

The Bank of New York Mellon has failed in its bid to dismiss a lawsuit that alleges it lost more than $1 billion by mishandling pension funds’ investments in Lehman Brothers

Next economic crisis to come from pension funds

Unregulated pension fund industry will be a systemic concern

Risk institutional investor rankings 2012

Deutsche on top

Australian super funds look to cross-currency basis swaps

Cross purposes

Market unrest prompts caution over commodities as diversifying asset class

Diverse strategies

Legal & General produces first index for Source commodity ETF

Legal & General Investment Management has created a commodity index that serves as the basis for a new ETF launched in partnership with Source

Meeting the volatility challenge of guaranteed products

No guarantees

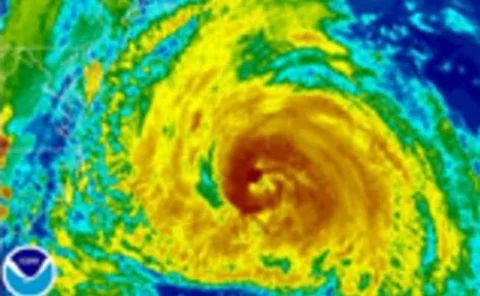

Sovereign debt crisis spurs investment in cat bonds

Life insurers and pension funds using insurance-linked securities as diversifier, as deal activity jumps in fourth quarter

Solvency II for pensions could be ‘killer blow’ for UK schemes

Solvency II for pensions could be ‘killer blow’ for UK schemes

Investment structure key to attracting pension funds to UK infrastructure plan

Investment structure key to attracting pension funds to UK infrastructure plan

Sponsor covenants in risk-based capital

Sponsor covenants in risk-based capital

Inflationary pressures spur pension funds to seek hedges

Inflated concerns