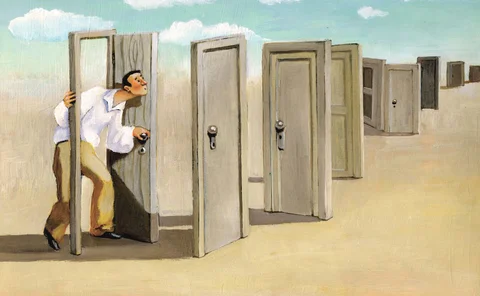

Operational risk

WHAT IS THIS? Operational risks are those arising from people, processes and systems – the biggest form of exposure for many industries, but one that was neglected by financial firms until the collapse of Barings Bank in 1995. It was added to the Basel capital framework in 2004, but attempts to model operational risk were dealt a heavy blow by the huge, unforeseen losses suffered by banks in the aftermath of the financial crisis.

Banks and CCPs clash over non-default losses

Banks balk at being on the hook for losses from investments or cyber attack, but many clearers say the risk should be shared

How will banks suffer large op risk losses in the future?

Eight interlocking trends mean more multi-billion-dollar losses to come

The death of one thousand flowers or the AMA reborn?

The author of this paper explores the reasons for the pending demise of the advanced measurement approach (AMA) to operational risk.

Optimal B-robust posterior distributions for operational risk

The aim of this paper is to integrate prior information into a robust parameter estimation via OBR-estimating functions.

RBS mortgage mis-selling returns to haunt lender

Megan van Ooyen from SAS rounds up the top five op risk losses for October

Operational risk modelling – finally?

Sponsored feature: Elseware

The benefit of using random matrix theory to fit high-dimensional t-copulas

This paper uses simulation studies and an example of operational risk modeling to show the necessity and benefit of using RMT to fit high-dimensional t-copulas in risk modeling.

Why did the crisis cause such large op risk losses?

Huge losses from the 2008 crisis can be seen as a short option position

Can the AMA be reborn?

Regulators could rescue op risk modelling through Pillar 2, writes former supervisor

From Russian roulette to overcautious decision-making

Risk-taking ought to be judged by its necessity, not likely outcomes, says Ariane Chapelle

Tweaks to standard op risk method not enough, experts warn

Basel Committee to integrate insurance and divestitures, but SMA still lacks forward-looking approach

Energy risk teams explore use of KRI metrics

KRIs show particular promise for managing operational risk

Wells Fargo pays the price for ‘ghost account’ fraud

Megan van Ooyen from SAS rounds up the top five op risk losses for September

Operational risk and the Solvency II capital aggregation formula: implications of the hidden correlation assumptions

The authors of this paper analyze the Solvency II standard formula for capital risk aggregation in relation to the treatment of operational risk capital.

Interview: US Treasury CRO on credit risk, Tarp and cyber threats

Ken Phelan stresses importance of credit risk management in key Treasury role

Custom models work better for op risks, research finds

Bayesian approach touted for mis-selling and other management failures

BoE lays out blueprint for RTGS reboot

Central bank plans “comprehensive rebuild” of payments platform

Two-regime approach saves up to 30% op risk capital

Modelling shift to 'crisis mode' mitigates pro-cyclical calculations

The missing piece in operational risk appetite

Setting an op risk appetite is illogical without reference to reward, argues Ariane Chapelle

Comments on the Basel Committee on Banking Supervision proposal for a new standardized approach for operational risk

In this paper, the behavior of the SMA is studied under a variety of hypothetical and realistic conditions, showing that the simplicity of the new approach is very costly.

Should the advanced measurement approach be replaced with the standardized measurement approach for operational risk?

This paper discusses and studies the weaknesses and pitfalls of the SMA and the implicit relationship between the SMA capital model and systemic risk in the banking sector.

AIG hit by $230 million settlement over MedPartners

Megan van Ooyen from SAS rounds up the top five op risk losses for August

Risk managers take note: Brexit was not a black swan

Protecting yourself against true black swans is the art of the possible, not the probable

US Bank’s op risk chief on terrorism and continuity

Jodi Richard explains overhaul of firm’s op risk programme, including crisis management plans