Mortgages

Swiss loans may struggle with Libor transition, warn lawyers

Lack of standardisation means fallback clauses may be unable to handle move to Saron

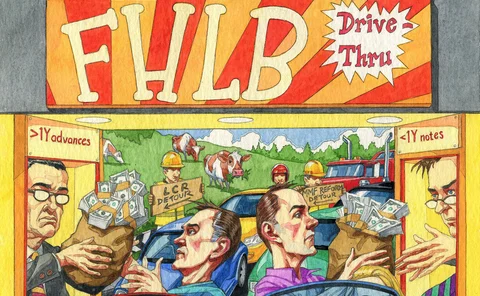

Soaring Fed Home Loan Bank borrowings spark systemic risk fears

Parallels drawn with Fannie and Freddie as commercial bank borrowing from FHLBs nears $500bn

‘Catching the outliers’ does not always make sense for Basel

The capital impact of Basel III on Nordic banks is disproportionate to the risks they face

FRTB, CCAR and bonus caps for prop traders

The week on Risk.net, December 16-22, 2017

Addressing probationary period within a competing risks survival model for retail mortgage loss given default

This paper presents a novel approach to modeling retail mortgage LGD estimation.

US hedge accounting changes could spur small bank swaps boom

Banks eye opportunities to claim hedge accounting treatment for fixed-rate portfolios and callable debt

Canadian CROs play down threat of mortgage exposure

Burgeoning loan portfolios no cause for concern despite Moody’s downgrades, risk chiefs claim

SSA deal of the year: Fannie Mae

Risk Awards 2017: Mortgage giant refines risk-sharing deals as political landscape shifts

Bank treasuries grapple with IRRBB data requirements

Banking Book Risk Summit: Data from recent zero rates era not a reliable behavioural indicator

A prudent loss given default estimation for mortgages

The author of this paper proposes a prudent methodology to correct for potential biases in LGD estimations due to historical price appreciations, appraisal biases and wear-and-tear or potential damage to the house.

Benchmarking the loss given default parameter for mortgage loan portfolios under stress

The authors analyze the impact of a decline in property prices that leads to stressed recovery rates for collateral on the loss given default (LGD) parameter in portfolios of mortgage loan.

Interview: US Treasury CRO on credit risk, Tarp and cyber threats

Ken Phelan stresses importance of credit risk management in key Treasury role

Modeling the current loan-to-value structure of mortgage pools without loan-specific data

This paper presents a method for approximating the current loan-to-value (CLTV) and remaining principal structures of heterogeneous mortgage loan pools.

Banks seek clarity on risk retention capital charges

CMBS issuers in dark about how much capital to hold against risk retention exposures

Regulatory miasma makes life difficult for Ocwen CRO

Op risk veteran Marcelo Cruz says firm faces “absurd” quantity of rules in US mortgage market

Research on equity release mortgage risk diversification with financial innovation: reinsurance usage

This paper examines the risk diversification of ERMs via the reinsurance strategy.

Nine years later, RMBS woes still haunt banks

Megan van Ooyen from SAS rounds up the top five operational risk losses for April 2016

Freddie Mac reviews $600bn hedge book as losses mount

Swap spread inversion contributed to derivatives losses of $2.7 billion in 2015

Counting processes for retail default modeling

The article discusses the use of counting processes for retail (mortgage) default modeling.

Apra toughens mortgage risk weights for Australian banks

Financial stability fears drive regulators to raise capital levels for banks

Q&A: Finansinspektionen's Uldis Cerps on capital floors and too-big-to-fail

Floors framework should not overstate risk, says Sweden's bank supervision chief

Capital floors could spur risk-taking – Swedish FSA

"Very careful" calibration needed to avoid bad incentives, says senior supervisor

Asset manager of the year: DoubleLine Capital

Risk Awards 2015: Critics challenged to look at the data by fund branded ‘not rateable’