Mortgages

BoE floor could double capital charges on HSBC’s UK home loans

New rules could forcibly push up residential mortgage portfolio’s 5% risk density

The unintended consequences of ring-fencing

Rules aimed at protecting UK depositors may be putting too much froth into the credit market

Safety first: UK set to keep ring-fencing but may ease rules

There is also pressure to make changes to tackle banks’ overexposure to retail debt due to the rules

Loan losses: Banks’ estimates out of sync with Fed’s

Wells Fargo worst performer in latest DFAST exercise

At Lloyds, more loans miss repayments as they exit moratoria

Majority of delinquent loans are mortgages

NatWest cut markets unit RWAs by almost one-third in 2020

NatWest Markets now makes up 16% of group RWAs

NAB’s bad loans ratio climbs as Covid moratoria expire

Australian lender sees percentage of past due and impaired loans hit 1.18%

Parallel lines: EU begins fight over Basel output floor

Leaked plan to exclude buffers from floor would please EU banks, could anger Basel and US

US banks cede to SOFR lending as credit hopes fade

Critics of risk-free rate say dynamic spread will be too late for transition

New Tradeweb/IBA benchmark tipped as ‘competitor’ to SOFR

Forward-looking risk-free rate aimed at US mortgage market could have broader applications

Discover, Capital One loans ravaged by Fed stress test

Credit card losses especially pronounced among regional US lenders

SOFR phase-in for cash products sparks ‘mismatch’ fears

Official proposal for one-year transition period could lead to basis risk, participants say

Bleak macro view pushes Lloyds’ ECL over £5bn

Anticipated loan losses for commercial loans up 39% on end-2019

RFRs hit Main Street as Swiss banks launch Saron mortgages

Negative rates ease path for compounded Saron home loans without lags or lookbacks

Lawyers pick holes in Libor statutory fix

US ‘tough legacy’ contracts open to legal challenge even if proposed New York law is passed

CECL models may leave banks ill-prepared for next downturn

Mortgage backtest study shows some loan-loss models miss the mark

Top 10 operational risk losses of 2019

Fraud, embezzlement, tax evasion, subprime (still) and rogue trading – and Citi crops up twice. Data by ORX News

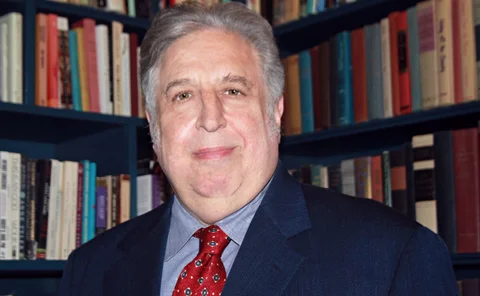

A new leaf: why a hedge fund manager bought a bank

Andy Redleaf founded a $6 billion hedge fund. Now he runs a small community bank

Chafing under capital rules, JP Morgan sells home loans

Standardised risk weights for residential mortgages far exceed modelled equivalents

Q&A: CFTC’s Behnam on tackling market risk in climate change

Commissioner wants to see new derivatives products to help mitigate climate threat

In hunt for yield, US insurers turn to illiquid assets

Mortgage exposures grow 72% in eight years since 2010

US Bancorp slashes bad assets 5% in Q2

Total amount of toxic assets stood at $953 million at end-June

Stress test projected loan losses fall $18bn

Credit card loss rates account for 36.3% of total loan losses under severely adverse scenario

Now under aegis of ECB, Nordea RWAs spike 29%

Imposition of Swedish mortgage floor adds €10.6 billion of risk-weighted assets alone