Loss

A new metric for liquidity add-ons: easy as ADV, but better

Proposed measure allows brokers to calculate stable, stock-specific liquidity add-ons

JP Morgan flirts with VAR limits

Largest trading loss in Q2 reached 96% of bank’s VAR limit

EU stress tests: BNP Paribas would bear brunt of trading losses

Losses from held-for-trading balance sheet would wipe out fair value book gains

‘It’s the economy’: forecasting an op risk climate change spike

History of op risk suggests economic impacts of climate change could exacerbate losses, writes op risk head

Morgan Stanley sets aside $73m for credit losses

Bank returns to stash reserves triggered by one facility in Q2

Covid-forborne EU loans sour faster as more exit moratoria

Exposures classified as stage two rose 37% in the first three months of 2021

Loan losses: Banks’ estimates out of sync with Fed’s

Wells Fargo worst performer in latest DFAST exercise

NSCC caught $600m short during meme-stock frenzy

Worst-case losses would have wiped out the CCP’s available liquid resources on one day in Q1

Canada’s top banks cut loan-loss provisions by $1.2bn

The decrease in set-asides represents a 92% fall quarter on quarter

US unit of BBVA on the brink of a VAR breach in Q1

Largest loss-to-VAR ratio at the firm was highest among the 12 intermediate holding companies

Credit Suisse held just 10% margin against Archegos book

Swiss bank gave family office 10 times leverage, compared with four or five times at Goldman

Top 10 op risks 2021: data compromise

Remote working elevates fears of data theft, misuse and abuse

Op risk data: In fewer reg fines, US took its lumps in 2020

Also: Retro Russian embezzlement fines; Barclays slapped for lack of forbearance. Data by ORX News

Buffer stops? Why banks haven’t used Covid capital relief

Amid weak credit demand, banks haven’t availed themselves of capital buffers, but they still might

EU’s dividend ban overshadows reform effort

Banks may be reluctant to run down buffers even if regulators soften the MDA threshold for payouts

Regions deploys early-warning tool for credit risk

Risk USA: system alerted US superregional to impending defaults during Covid crisis

Op risk data: Firm-wide control fails cost Citi $400m

Also: Deutsche draws fire and AML fine over Danske trades. Data by ORX News

One man’s trash is another man’s Treasury

With yields at record lows, investors are asking how much protection bonds will offer in a future crisis

Banks fold climate, pandemic and cyber risks into CCAR

OpRisk North America: anchoring idiosyncratic risks to macro scenarios a challenge, say experts

IFRS 9 and the loan loss lottery

As reserves for bad loans balloon, banks grapple with measuring Covid-era credit risk

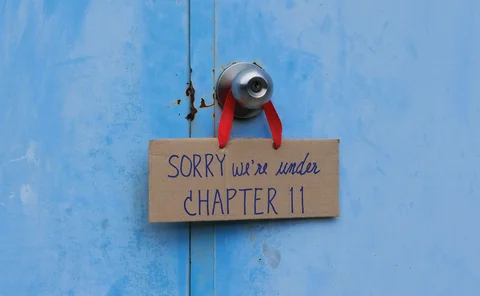

Altman: mega-bankruptcy wave coming

Credit conditions were worsening before Covid, research finds

Asia collar financing surges on back of Covid-19 volatility

Options-based structures gain ground on margin loans – and dealers say it may be a structural shift

Discover, Capital One loans ravaged by Fed stress test

Credit card losses especially pronounced among regional US lenders

Studies test investors’ risk aversion after crash

Researchers use March tumult to investigate psychology of risk-taking