Libor

Libor limbo: loan market fallback language upends lenders

Banks seek to replace painful fallback language in loan docs and avoid a cost-of-funds contingency

Isda plans February rerun of Libor pre-death trigger poll

Lack of consensus would add pre-cessation option to post-cessation protocol for bilateral swaps

Libor replacement jumble may hike hedging costs

Use of term rates and credit adjustments will create new basis risks that could be costly to hedge

Regulators urge buy-side action on Libor shift

ARRC set to release ‘checklist’ for buy-side firms, while FCA assesses exposures

LCH targets hardwired pre-cessation triggers

Proposal aims to align transfer pricing for cleared and bilateral markets in the event of split on ‘zombie Libor’ triggers

New pre-cessation poll likely as FCA quells zombie Libor fears

Minimal non-representative lifespan opens door for rerun of Isda trigger consultation

Aberdeen head of structured solutions departs

De Roeck considering Libor discontinuation consultancy launch

BofA nabs top market risk quant from Deutsche

Move for senior risk analytics exec comes as go-live for FRTB approaches

Signing the Libor fallback protocol: a cautionary tale

As Orwell’s Room 101 beckons for Libor publication, muRisQ Advisory’s Marc Henrard warns of a potential pitfall in the fallback protocol

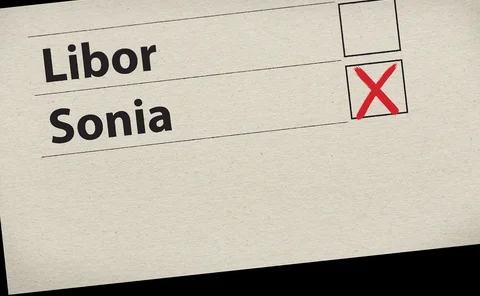

Judgement day looms for dealers in swap shift to Sonia

Regulator pushes Q1 deadline for users to adopt risk-free rate as norm for interdealer trades

EU compounding confusion creates headaches for banks

With the fallback possibly illegal in some EU states, loan system updates may become more complicated

Lloyds plans £4bn Sonia shift for covered bond extension clause

Consent solicitation aims to flip one-year Libor-linked grace period on fixed instruments to RFR

Review of 2019: shaken, not stirred

The market survived a cocktail of hits. But is a hangover on the way?

First Ibor versus SOFR cross-currency swap trades

Westpac and Citi strike BBSW/SOFR trade in landmark moment for Australian market

Sonia users push for official in-arrears rate

US Fed proposal for compounded SOFR index leads to calls for endorsement of NatWest’s Sonia calculation

In the US, it’s an even ‘tougher legacy’ for Libor

A legislative solution for cash products is in the works, but lawyers say it raises constitutional issues

Compounded rate out of favour, finds Japan survey

Users prefer forward-looking term rate to replace yen Libor, but dealers bemoan “lack of understanding”

Zombie Libor, climate risk flaw, Mifid’s closed door

The week on Risk.net, December 7–13, 2019

Initial margin – A regulatory bottleneck

With the recent announcement of an extended preparation period for those smaller entities needing to post initial margin under the uncleared margin rules, the new timetable could cause a bottleneck for firms busy repapering derivatives contracts linked…

Degree of influence: Regulatory policies drive quantitative research

Counterparty risk and market risk hold centre stage, data science moves up, quantum computing debuts

Euribor fallbacks could hit thin legal ice

In Italy and Germany, compound interest – the foundation of Euribor fallbacks – is actually illegal

BMR rift fuels zombie Libor uncertainty

False rate could limp on for months under EU’s benchmark regulation

Isda to poll Libor users on pre-cessation triggers, again

Trade body seeks clarity on zombie lifespan and CCP response as it bows to regulatory pressure

Interest rate derivatives house of the year: Goldman Sachs

Risk Awards 2020: US bank leads the way on SOFR, and gets creative to facilitate US insurer hedging