Leverage

Credit risk – The bank data challenge in frontier markets

As the regulatory net tightens, banks working in and across frontier regions are under pressure to source and maintain more accurate data in the assessment of counterparty credit risk, but some are investing in tools to tackle the problem

Esma trains beam on investment fund risks

Officials look to regulatory reporting for better grasp of fund leverage and liquidity

Hedge funds levered up in 2018

Relative value funds have highest adjusted leverage, at 7,155%

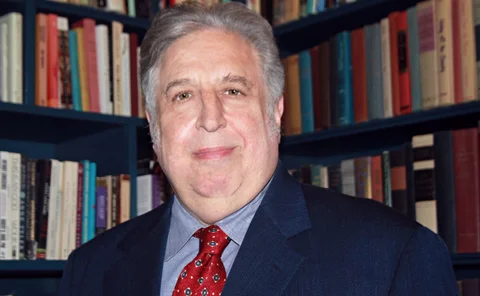

A new leaf: why a hedge fund manager bought a bank

Andy Redleaf founded a $6 billion hedge fund. Now he runs a small community bank

Loosening ties, pt 1: how US G-Sibs cut intra-system assets

Goldman Sachs reduced links with other financial firms the most in Q4 2018

G-Sibs in US grow leverage exposures faster than EU rivals

HSBC saw exposures fall 2.81% in Q3

Initial margin – A regulatory bottleneck

With the recent announcement of an extended preparation period for those smaller entities needing to post initial margin under the uncleared margin rules, the new timetable could cause a bottleneck for firms busy repapering derivatives contracts linked…

Competitive differentiation – Reaping the benefits of XVA centralisation

A forum of industry leaders discusses the latest developments in XVA and the strategic, operational and technological challenges of derivatives valuation in today’s environment, including the key considerations for banks looking to move to a standardised…

Regulatory relief, but the pressure is still on

As the new compliance schedule for IM requirements on non-cleared derivatives comes into force, IHS Markit’s director, derivatives data and valuation services, Kashyap Sheth outlines what to expect next

JP Morgan debuts Nexus spinoff for hedge fund exposure

Bank launches matchmaking service for lonely hedge funds and return-hungry investors

Off-balance-sheet exposures at JP Morgan climb $19.8bn in Q3

Goldman Sachs expands off-balance-sheet exposures 10% quarter-on-quarter

At Wells Fargo, derivatives exposures climb $13bn in Q3

Portfolio shifted further into-the-money in the third quarter

Successfully moving risk software to the cloud

Cloud technologies offer numerous benefits over traditional on-premise deployments. While the rate of adoption in the financial services industry was initially slow, banks and asset managers are now embracing these technologies and moving their…

Commerzbank plumps capital buffer with AT1 bond sale

Bail-in instrument helps expand buffer above MDA limit to around 220bp

Fed’s repo operations will not fix rate spikes, dealers say

Risk USA: leverage constraints remain, even after massive injections of emergency liquidity

Structural snags frustrate STS for synthetics

Curbs on excess spread and collateral stymie route to ‘high-quality’ signifier

Stress-testing to improve strategic decision‑making

Banking regulators remain focused on expanding and developing the range of stress-testing regimes across the globe to maintain stability, monitor emerging risks and avoid another financial crisis. Here, a forum of industry leaders discusses the evolution…

RBS’s leverage ratio sinks as balance sheet swells

NatWest Markets RWAs also increased on the quarter as derivatives positions deteriorated

Debt and the oil industry: analysis on the firm and production level

This paper analyzes the relationship between debt and the production decisions of companies active in the exploration and production of oil and gas in the United States.

Some eurozone banks have thin leverage capital buffers

Tier 1 capital surpluses above regulatory minimums range between 31% and 123%

ETF strategies to manage market volatility

Money managers and institutional investors are re-evaluating investment strategies in the face of rapidly shifting market conditions. Consequently, selective genres of exchange-traded funds (ETFs) are seeing robust growth in assets. Hong Kong Exchanges…

Deploying agile analytics in the fight against fraud

Financial firms are under pressure to tackle the widespread problem of financial fraud. As the speed, scale and sophistication of fraudulent activity grows, a panel of financial crime experts reveal how firms can develop an agile analytics capability to…

Harnessing AI to achieve Libor transition

Chris Dias, principal at KPMG, explains how the vast increase in accuracy that artificial intelligence (AI) offers when dealing with large volumes of complex agreements is crucial to exploring the market opportunities and mitigating the risks of the…

Off-balance-sheet exposures at US systemic banks jump $67bn

BAML expands these assets by 2.5% quarter-on-quarter to $921 billion