Leverage

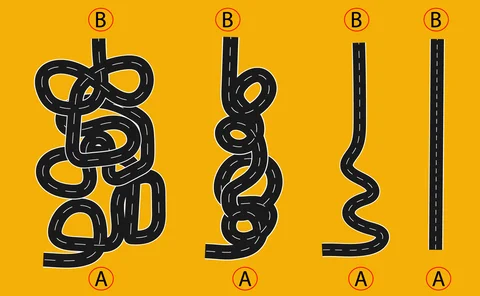

Was Archegos default a one-in-a-million event?

BoE quant says neglecting high leverage and WWR may create conditions for similar blow-ups

Collateralised exposure modelling: bridging the gap risk

Concentration, leverage and correlations may affect a collateralised equity swap portfolio

ECB ratchets up Pillar 2 charges across top lenders

UniCredit, BNP Paribas, SEB and Swedbank worst-hit in latest SREP round

Pricing in the gap risk of mini-futures

Mini-futures need to be priced and hedged taking sudden jumps into account

Japan dealers’ derivatives exposures keep inflating

MUFG, SMFG and SMTH added almost ¥6 trillion to their balance sheets in the three months to end-September

Global banks’ systemic footprint grew at record pace in 2021

Every indicator up on previous year, only the second time in G-Sib assessment history

Cross-border risk dominates 2022 G-Sib scores

Overseas lending and borrowing largest contributor to scores of banks in Canada, EU, Japan, Singapore, Switzerland and UK

Barclays, Deutsche, Credit Suisse take $437m hit on leveraged loans

Higher interest rates eroded value of facilities stuck in pre-syndication during Q3

Hong Kong, India, Turkey lag behind on Basel III framework

Only Canada, Japan and Saudi Arabia ready for full implementation as January deadline approaches

European banks set for 17.5% capital hike under Basel III

Output floor could account for almost half the increase in Tier 1 capital requirements by 2028

BoE intervention whipsaws pension funds that dumped hedges

Unhedged funds saw liabilities rise by up to 20% when rates pulled back

Keep risk parity simple, stupid

In times of volatility, simpler risk parity strategies may outperform more elaborate counterparts

BNY Mellon, Schwab would benefit most from SLR relief

A repeat of the pandemic carve-out would boost average ratio across US banks by 45bp

EU banks’ leverage ratios slip as ECB relief ends

Lenders still carving out central bank balances in March saw ratios drop 60bp on average

Top Fed watchdog supports non-bank Sifi designation

Vice-chair Barr complains regulators lack “even basic data” on some areas of shadow banking

Credit checks, what credit checks? How crypto lending ate itself

Collapse of hedge fund Three Arrows Capital exposes “sloppy and irresponsible” credit standards among crypto lenders

SEC commissioner wants power to block single-stock ETFs

Listings of funds that pay out when Tesla or Pfizer shares fall prompt call for tougher regulation

Hedge funds warn SEC dealer rule is ‘unenforceable’

Private funds say they are collateral damage of poorly drafted push to regulate PTFs

Fed ‘tailoring’ led to larger, less capitalised regional US banks

Lenders freed from toughest requirements in 2018 grew balance sheets but saw capital ratios slip

Credit Suisse goes off piste in latest DFAST

US unit of Swiss bank underestimated leverage hit in Fed stress test

HSBC exhausts leverage headroom in Fed stress tests

Goldman Sachs worst performer among US banks

FSB warns on Archegos-style leverage

Isda AGM: Knot takes dim view of banks piling up leverage blind

How to model potential exposure, post-Archegos

BofA quant’s model considers the correlation between market shocks and counterparty defaults

Credit Suisse cuts leverage exposure by $11.5bn

CET1 leverage ratio remained flat over Q1 as drop in capital more than offset cuts in prime brokerage business