Leverage ratio

Q&A: the Bundesbank’s Andreas Dombret on small banks, big banks and shadow banks

Supervisors are “miles” from being able to monitor shadow banking risks, says financial stability head.

In-depth introduction: Clearing incentives

Price hikes at Goldman Sachs show how much pressure FCMs are under

China banks ready for tougher leverage ratio rules

State-owned and private banks already above 4% standard regulators are introducing

Nouy: Europe should keep 3% leverage ratio

SSM chair also wants to end rule opt-outs that make banks "look stronger than they really are"

Goldman hikes clearing fees by 75bp as leverage ratio bites

New fee structure amounts to a fourfold increase in some cases

Unclear incentives: do capital and margin rules support CCPs?

Regulators see incentives to use cleared swaps; critics claim analysis is flawed

Basel will address leverage ratio threat to clearing

FAQ document to tackle treatment of segregated initial margin

SunGard unveils clearing utility as FCM exit fears grow

Barclays is first client for service that promises 20% savings for FCMs

What links Schumpeter, market structure and Basel III?

Regulators are hoping higher capital levels will translate into healthier markets

Goodbye Sonia flat: banks rethink swaps with bond collateral

Higher discount rate can cut payouts to in-the-money clients by millions

KVA: banks wrestle with the cost of capital

As the bank capital burden grows, dealers are trying to price in the associated costs

Banks blame regulation for FCA's clearing worries

UK regulator warns client clearing could become a “missing market” but defers study

UBS takes Sfr4.2bn of client collateral off balance sheet

Accounting change cuts futures clearing leverage exposure

Massad backs leverage ratio changes

CFTC chairman “very concerned” about negative impact on clearing

House committee calls on Fed to change leverage ratio

US politicians argue "unwarranted" capital burden will hike end-user costs

The invisible incentives of clearing

Leverage ratio is making life difficult for clearing's gatekeepers

Wells Fargo: clear ambition

Low leverage gives clearing newcomer a chance to expand

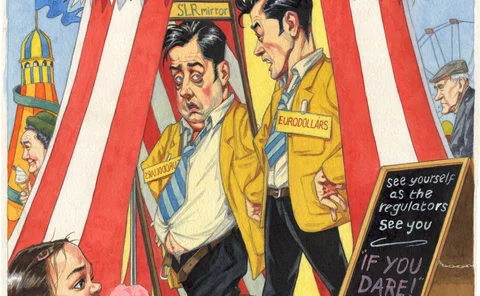

Leverage ratio threat to Eurodollar liquidity

Cost of benchmark contract will rise and liquidity will fall, clearers warn

Grim repo: clearing touted as saviour for shrinking market

CCPs wary of risks as they vie to launch buy-side repo services

CME fears futures clearing retreat

Leverage ratio could prompt FCMs to be more picky, warns CME's Sprague

CME and LCH.Clearnet prep buy-side repo clearing

New clearing services could offer cross-margining benefits

OTC infrastructure service of the year: TriOptima

Risk Awards 2015: TriReduce to the rescue

OTC client clearer of the year: Citi

Risk Awards 2015: US bank a hit with clients, despite headwinds

Clearing house of the year: LCH.Clearnet

Risk Awards 2015: UK clearer could unlock leverage ratio