Interest rates

CIBC’s VAR hits highest since 2008 amid interest rate risk surge

Client and market-making activities responsible for 44% increase

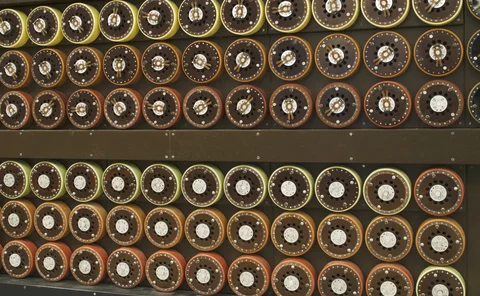

How steepener trades burned hedge funds, and what happened next

Delays to central bank rate cuts torpedo popular trade, causing funds to pull capital – to the chagrin of sell-side desks

ABN Amro, Intesa lead EU IMA users with RWA surges

Rates volatility tests models in their twilight years before FRTB forces shelving

Decoding the decoupling in US and eurozone inflation

ECB rates cut and Fed’s refusal to follow suit point to differing fundamentals in stateside and EU economies

Euribor fills panel gaps with Finland and Greece

OP Corporate Bank and NBG take contributors to 21 as administrator switches off “expert judgement”

Shocks to the system: how Basel IRRBB update affects new EU test

Disclosures suggest more banks will be classified as outliers on net interest income assessment

ANZ’s end-period VAR spikes to highest in a decade

Interest rate risk drives 53% surge; market risk up A$1.6bn

NYCB doubles down on borrowing as deposits keep ebbing

Wholesale funding made up a third of the bank’s interest expense in Q1

Canada’s triparty repo launch aims to fill C$60bn void

Test trades on TMX/Clearstream platform represent “quantum leap” for creaking funding markets

State Street loads up on short-term borrowing as rates spike

Funding rejig comes amid surge in deposits

Consortium backs BGC’s effort to challenge CME

Banks and market-makers – including BofA, Citi, Goldman, Jump and Tower – will have a 26% stake in FMX

AOCI worsens across the board at US banks in Q1

JP Morgan, Wells Fargo and Citi hit hardest in trend reversal

Who’s winning the €STR futures race? Depends how you measure

CME, Eurex and Ice all claim to be leading, but experts say it’s too early to pick a winner

Seven banks under SEC scrutiny over interest rate risk disclosures

Regulator-issued letters aim at boosting transparency on EVE and NII sensitivity

US banks’ non-core funding dependence ratio jumped in 2023

BHCs’ aggregate figure almost doubled to post-pandemic high last year

EU banks’ incremental risk charges soared in volatile H2

Charge for traded-bond default and downgrade risk hit 10-year high at BNP Paribas

BGC forming consortium to take on CME Group’s rates empire

Banks and PTFs are being offered a stake in FMX, which has CFTC approval to launch a futures exchange

BTFP shutters with loans at near-record high

Program saw last-minute $3bn dash for loans in final three days of operation

Adapting buy-side risk management strategies for complex market dynamics

Luke Armstrong from S&P Global Market Intelligence, Thomas Sheedy from Invesco and Julien Cuisinier from Artemis Fund Management explore the challenges and adaptive strategies shaping the evolving field of buy-side risk management

Japan’s interest rate derivatives trading and clearing on the rise

Japan Exchange Group and OpenGamma chart Japan’s journey towards a flourishing derivatives trading and clearing ecosystem

Clobbered: how ‘toxic’ flows reshaped US Treasury trading

Volumes have dropped by more than a third at BrokerTec. The reasons are complex, the outlook uncertain

Higher revenue pushes HSBC’s op risk up 14%

Increased net interest income over 2023 major driver behind six-year high figure

ECB raised Pillar 2 charges for just three CRE-heavy banks in latest SREP

Pfandbriefbank and Luminor saw largest increases across 106 banks subject to 2023 assessment

FX options traders rethink vol drivers amid macro uncertainty

Market-makers believe more and more events will influence options pricing as political risk bubbles up during 2024