Insurance

NAIC proposal sees insurers snub debt rated by smaller agencies

Ability of some corporates to raise capital ‘materially impaired’, bankers say

An NAIC plan to second-guess bond ratings is ‘nonsensical’, insurers say

Proposal to create “quasi rating agency” at regulatory body sparks backlash from industry and US Congress

Allianz Life triples index CDS book

Counterparty Radar: US life insurer market’s notional volume doubles in Q1

US insurers face 15% capital hike for CLO equity next year

Insurance regulator agrees ‘compromise’ solution to delay increase until 2024

MassMutual drives JP Morgan’s FX forwards surge with insurers

Counterparty Radar: Bank’s total values rise 72% in Q4 to crack top 10 dealer rankings for first time since Q2 last year

UK pension fund buyouts frustrated by ‘dirty’ CSAs

Contracts allowing schemes to post corporate bonds as collateral are obstructing risk transfer to insurers

ERM reboot: how insurers are turning risk decisioning into strategic advantage

Enterprise risk management is a powerful strategy to identify, assess and manage risks across the business. For insurers, two ERM objectives are critical: ensuring regulatory compliance and establishing a framework for healthy investment risk appetite

Allianz Life halves index CDS book in Q4

Counterparty Radar: Move by US market behemoth pushes life insurers’ notional down by almost 40%

Fat tails and optimal LDI portfolios

A portfolio optimisation technique for pension funds and insurance portfolios is presented

ERM reboot: how leading insurers are turning risk decisioning into strategic advantage

An expert discussion exploring how leading insurers are adapting ERM systems in support of a wider range of opportunities, helping to avoid losses, navigate unstable markets and maintain a strong reputation

US insurance regulators move to kill CLO arbitrage

Capital charges on collateralised loan obligations will be model-based after 2024

Insurance institutional shareholding and banking systemic risk contagion: an empirical study based on a least absolute shrinkage and selection operator–vector autoregression high-dimensional network

The authors use a LASSO-VAR method and generalized variance decomposition to measure the systemic risk contagion effect of Chinese-listed banks.

UK life insurers pass BoE stress test with 64% hit to surplus capital

Sector deemed resilient, but plausibility of some management actions questioned

Financial firms rethink after cyber insurance premium spike

Brokers say there are signs pressure is easing, but quantum hacking threat could transform market

Review of 2022: Fighting on all fronts

Macro headlines unleashed micro-horrors, as margins soared, correlations cracked and crypto markets imploded

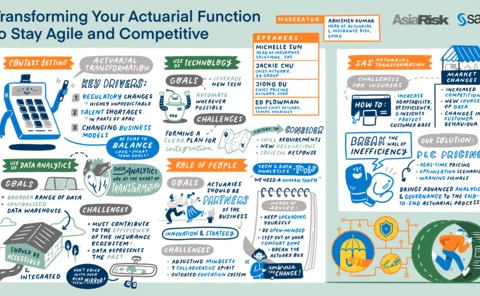

Transforming your actuarial function to stay agile and competitive

While transformation is important, its success depends on putting data in capable people’s hands

Allianz, Generali post €52bn in fair value losses in H1

Bond portfolio values crash as equities tailwinds fades

US pensions take hit as illiquid assets prove hard to shift

Corporate plans forced to sell alts at discount as insurers baulk at riskier investments

Cohen & Co yields 8% by lending to unrated insurance companies

Small firms in ‘the safest industry in the world’ can’t raise capital, creating a trading opportunity

Bermuda ‘examined’ PE insurers criticised by US senator

Premier David Burt is ‘confident’ pension assets reinsured on the island are ‘appropriately’ regulated

Basel rules mean banks can’t compete with Coinbase – Goldman

Proposed 1,250% risk weight for crypto holdings undercuts banks’ push into burgeoning market

SEC rule could stop pension funds investing in hedge funds

Hedge funds need to hold insurance to win US pension plan money. New rules would make cover too dear

Adapting to the new normal

The current interest rate environment and need to adapt to changing technology and regulatory mandates is keeping insurers on their toes, Nakul Nayyar, head of investment risk at Guardian Life, tells Risk.net

What do regulators need from governments on climate change?

To reduce the number of climate risk scenarios, lawmakers need to start being more specific