Inflation

Inflation derivatives house of the year: Natixis

Risk Awards 2025: French bank’s hedge fund push boosts its flow standing and creates repack risk offsets

Thames Water: a handy guide for worried counterparties

The UK’s largest water company – now junk-rated – has £1.3bn in swaps liabilities. Dealers ought to be safe, but face a host of headaches and questions

How steepener trades burned hedge funds, and what happened next

Delays to central bank rate cuts torpedo popular trade, causing funds to pull capital – to the chagrin of sell-side desks

Bank treasuries should help monitor hidden optionality – JPM exec

Risk Live: JP Morgan ALM structurer calls for greater treasury involvement in product design

Decoding the decoupling in US and eurozone inflation

ECB rates cut and Fed’s refusal to follow suit point to differing fundamentals in stateside and EU economies

How Argentina’s financial tango could become a dance of death

Central bank and government’s unholy alliance is storing up further trouble for economy

FX books bulge in quant investment field

Carry strategies attract bulk of interest; banks eye growth in volatility, intraday and emerging market replication

Decades of history says you can beat high inflation with quality

Factors such as momentum and value generally outperform the market irrespective of inflation, but new research suggests quality stocks are best when prices are rising rapidly

Choppy inflation may be the worst inflation

Investors can build strategies to suit fast-rising prices, or slow-rising prices. What trips them up is the inflation foxtrot: slow, slow, quick, quick, slow

FX options traders rethink vol drivers amid macro uncertainty

Market-makers believe more and more events will influence options pricing as political risk bubbles up during 2024

‘Brace, brace’: quants say soft landing is unlikely

Investors should prepare for sticky inflation and volatile asset prices as central banks grapple with turning rates cycle

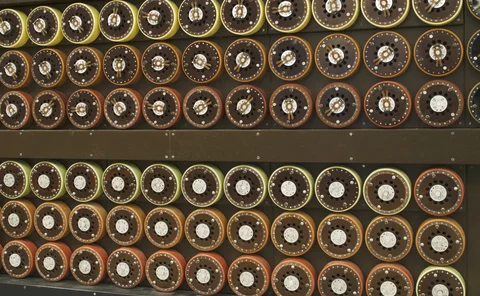

IM requirements for interest rate swaps up $30bn in December

Latest figures from CME, Eurex and LCH show a trend reversal from previous six months

UK inflation swap basis set to widen on green energy push

Hedging of planned wind farms will make bilateral receiver swaps cheaper versus cleared, say traders

Trend following struggles to return to vogue

Macro outlook for trend appears to be favourable, but 2023’s performance flop gives would-be investors pause for thought

Undeterred, hedge funds bet on euro swap steepeners

Expected rate cuts and pension reforms are driving steepener flows, but large pension funds may not be finished hedging at the long end

Emerging lessons from the current credit risk cycle

Experts discuss the challenges of higher inflation and interest rates, the impact on defaults, innovations in credit risk modelling and predictions for 2024

Structured credit: the outlook for 2024

In this webinar produced by Risk.net in association with Numerix, experts discuss the risks, opportunities and outlook for structured credit markets in 2024

Tackling credit risk in turbulent times

Survey reveals Apac CROs’ top credit risk priorities

Mirfendereski joins MUFG as inflation head

Former HSBC inflation chief joins Japanese bank in London after study break

Interest rate and liquidity risk special report 2023

This special report explores the ongoing impact of higher interest rates on bank capital and liquidity, and the steps they are taking to shore up their liquidity risk management practices in the current environment.

BNP Paribas bolsters inflation desk with new hires

French bank takes on two traders, including a European inflation specialist

MassMutual exited inflation hedges in Q2

Counterparty Radar: Closure of $1.5 billion book dealt a blow to BNP Paribas’s dealer ranking

Do all roads lead to multi-scenario Fed stress tests?

This year’s CCAR faced criticism for underweighting the risk of higher-for-longer inflation

Pre-merger, PacWest reported record negative NII growth

Funding costs continue to outpace income growth at majority of US banks