High yield

El-Erian on Covid-19 policy risks and central bank capture

Former Pimco chief says Fed has gone too far, market function rules needed and chance opens for shared policy load

Investors abandoned junk bond ETFs in March

Forced sale of ‘fallen angels’ could exacerbate outflows at end-April

Quants warn on credit risk in stocks

Conventional models may be missing explosion in novel exposure

‘Fallen angels’ pose little threat to EU funds

Passive fund outflows in a credit crisis would put pressure on high-yield bond prices

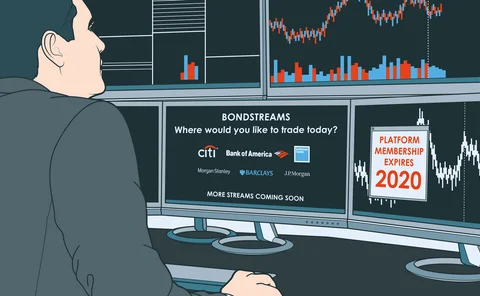

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Innovation in execution: Morgan Stanley

Risk Awards 2020: Odd-lot bot handles almost half of bank’s credit trades

EU high-yield funds at risk of liquidity shock – Esma

High-yield bond funds have just 13% of NAV in high-quality liquid assets on average

New frontiers

Innovative investment opportunities are helping to mitigate risk and satisfy Solvency II capital requirements as insurers face continued economic uncertainty. Frederic Morlaye, managing director, insurance and capital management solutions, Global Markets…

Saba’s Weinstein: ETFs ‘destroy value’ in junk bonds

Hedge funds wary of high-yield bonds; blame ETFs for shrinking liquidity premium

DoubleLine warns of debt rollover risk

Asset manager plans to be liquidity provider if US credit market is distressed

Northill: bubble building for direct lending strategies

Cat bonds, high yield, US distressed, infrastructure risky too

Systemic risks in the market on the rise, says Iosco economist

Shane Worner, senior economist at Iosco, warns of excessive leverage in the system

Institutional investors bond over fixed-income ETFs

Smart money favours high-yield and emerging markets debt

Europe’s high yield new issuance “lacks fundamentals”

Investors chasing returns risk defaults

Oaktree’s Howard Marks keeps specialisation at the heart of expansion

Trying to get it right

GLG European Distressed Fund: GLG Partners (Man Group)

13th Annual European Single Manager Awards 2013

Hadron Alpha Select Fund: Hadron Capital

13th Annual European Single Manager Awards 2013

Hedge funds split on outlook for junk bonds

Split on junk

High yield bond funds are an emerging risk: SFC video interview

Investors increasing their exposure to high yield bond funds is an area of concern, according to Bénédicte Nolens, head of risk and strategy at the Securities and Futures Commission

Lookback

Lookback

Sponsored statement: Standard Chartered

Asia’s local capital markets stand on the verge of a boom

Equity derivatives house of the year: UBS

Structured Products Asia Awards 2012

May sees US fixed-income ETP record despite flight from high-yield bond products

High-yield ETPs in the US experienced their first outflows since November 2011, but inflows into government bond products propelled May to a record-breaking month for fixed-income ETPs

iShares launches single-country eurozone debt ETFs

iShares is offering a play on uncertainty in the eurozone with the launch of eight ETFs that offer exposure to the sovereign debt of individual eurozone members