Emir

LCH units bolster liquidity buffers

Cash at central banks and with commercial banks higher in the second quarter

EU’s further intragroup clearing relief: banks want more

Esma proposes to extend exemptions from clearing obligation but industry wants permanent solution

Stuck in traffic: EU turf war holds up CCP resolution rules

Unsuitable rules for failed banks could be used to resolve French and German clearing houses

Brexit: listed derivatives face OTC mutation

No-deal would flip EU27 users into different regime for UK-listed trades

Day one of a no-deal Brexit: swaps and chaperones

Banks, trading platforms, repositories tee up EU entities – and dread the repapering crunch that would follow

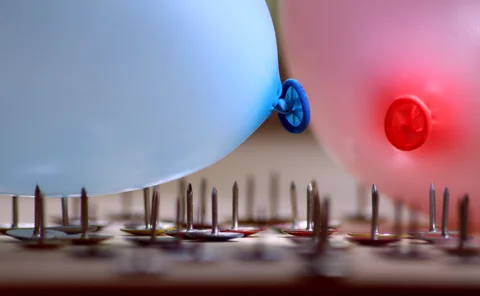

Skin in the game

This paper analyzes the cost of putting aside capital as skin in the game (SITG).

EU deadlock set to delay CCP resolution rules

Lawmakers disagree over whether Esma should be given new powers to tackle distressed CCPs

Corporates fear EU will spike Emir Refit reporting relief

Delegated reporting threatened by policy-maker objections to use of foreign banks

Optimisation services edge closer to EU clearing exemption

Lawmakers ask European Commission to consider if offsetting non-cleared trades could be exempt

EU drops reporting relief for exchange-traded derivatives

Exemption removed from Emir Refit, but Parliament moots future legislative changes for ETDs

Lessons for the next round of energy market regulation

More recognition of commodities' special features will make future regulation faster and smoother, argues energy expert

Q&A: EU’s Hübner on Brexit and future of equivalence

Top EU lawmaker discusses improvements to equivalence, contract continuity and clearing relocation

EU must think big to overcome Brexit’s impact on markets

Post-trade reforms offer lessons for Capital Markets Union project, writes EU lawmaker Kay Swinburne

French regulator: we are not the Brexit bogeyman

AMF denies pursuing relocations from UK, but calls on EU27 to build its financial markets

Eurex rejigs liquidity portfolio

Half a billion euros placed with commercial banks at end-March

Banks fear loss of Emir intragroup exemptions

Firms would have to clear or margin transactions with affiliates in non-equivalent jurisdictions

CCPs must step up cyber risk efforts, says EU legislator

Policymakers want more focus on non-default loss resources; Eurex Clearing’s Mueller flags investment risk

Esma questions CCP ‘free ride’ for sovereigns

Regulator has asked EC to take a stance on venues that let public entities clear without posting margin

Rolet is right – for now

CME/Nex deal could change the established logic on how to deliver rates market savings

EU’s evolving CCP resolution rules get mixed reviews

Isda AGM: Parliament tackles big issues in recovery and resolution text, but 'doesn’t go far enough'

Isins for swaps need ‘complete rethink’, say platforms

Three trading venues say Mifid II transparency objectives diminished by identifier choice

FCA: Libor contract changes shouldn’t trigger margin rules

Moving from Libor to an RFR shouldn’t force margin requirement on legacy non-cleared trades, says UK regulator

A floored plan: Europe’s CCP recovery rules draw fire

CCPs and clearing members both unhappy with proposed allocation of non-default losses

EU risks backlash on CCP supervision – UK MEP

Swinburne says US could retaliate over fears of “damaging blanket Brexit policy”