Emir

EU’s Brexit clearing grab slow to lift off

Clearing members say clients aren’t transferring material volumes from LCH to Eurex rapidly

EU banks expect further margin reprieve for equity options

Exemptions for intra-group and equity options from non-cleared margin rules expire by January 2021

Margin calls on eurozone funds rose fivefold in March

ECB data shows some funds faced liquidity squeeze as VM calls flooded in

Why bankers should embrace the Brexit political theatre

Treating equivalence as purely technical might not have the outcome that financial firms want

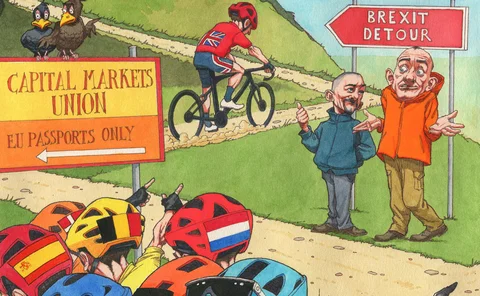

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

ECB mulls wider clearing house access to account facilities

Including CCPs in the Eurosystem may remove the need for them to seek a banking licence

Interdependencies in the euro area derivatives clearing network: a multilayer network approach

This paper provides insight into how the collected data pursuant to the EMIR can be used to shed light on the complex network of interrelations underlying the financial markets.

Watch out for Brexit cliff edge 2.0, experts warn

Measures to mitigate a sharp rupture for financial services could be less likely at end-2020

Esma trains beam on investment fund risks

Officials look to regulatory reporting for better grasp of fund leverage and liquidity

EU gives one-year margin reprieve on equity options

Regulators point to possible systemic risk in margin loophole, as industry urges parity with US

EU derivatives markets highly concentrated

CCPs hold 41% of interest rate derivatives notional exposures

Clearing experts fear tough EC stance on Emir 2.2

Industry disappointed final Esma advice did little to dial back on burdensome equivalence rules

Clearing house power-downs raise fears among members

Banks question CCP resilience to system outages, as debate swirls over non-default losses

EU to grant last-minute margin reprieve for equity options

European Commission to publish changes to Emir technical standards within days

Frandt or foe? FCMs hit back at Esma buy-side clearing salvo

Esma pushes dealers to publish standardised fee schedules amid clearing capacity fears

On CCP oversight, US and EU may be closer than they appear

Competing proposals on foreign CCP oversight have more in common than recent rhetoric implies

Central counterparties: magic relighting candles?

In this paper, the rules of selected major CCPs (LCH, CME, Eurex and ICE) are reviewed for both their end-of-waterfall procedures and the rights granted to clearing members in end-of-waterfall scenarios.

EU seeks to offer reassurance on Brexit clearing exemption

Commission can act quickly to stave off no-deal market disruption, insists official

EU banks seek last-minute margin reprieve for equity options

European dealers want exemption rolled over, to avoid handing US firms a regulatory advantage

Regulators plan to delay IM ‘big bang’ – market sources

Most see final phase of initial margin rules coming a year later, in September 2021

Swaps counterparties spooked by Emir position pairing

Stumble on voluntary position reporting could undermine push to reform ETD regime

CCP margin buffers too big, research suggests

Procyclicality calculations should depend on expected spikes in volatility, argue Ice risk experts

Resented elsewhere, Mifid finds love at Esma

Huge cache of data helped Esma spot market abuse and inform policy, head of market data policy says

US parries EU jab on CCP oversight

CFTC’s Pan questions Esma’s “very complex” test; EC’s Pearson calls it “more intelligent” than US’s