Equities

Société Générale downbeat on major asset classes in 2011

Equities and bonds are overvalued while commodities and emerging markets look equally unattractive, according to Société Générale's 2011 Outlook presentation

AK Asset Management's Turkish delight

Turkish delight

The Universa approach to hedging tail risk

Profiting from disaster

Look to equities and commodities in 2011, says BarCap

Barclays Capital’s December 2010 Global Outlook forecast for this year advises investors to buy commodities, credit and stay long-equities. Growth in 2011 is predicted to reach 4.5% as fears of a double-dip recession recede.

Coming inflation means UK pension funds should expand equity allocation

QE2 will spur above target inflation in 2011 and low real yields mean pension funds should look to shares

UK economic growth bodes well for equities, says Schroders

Schroders outlook for next year is positive, with the UK avoiding a double dip recession and equity markets rising. However, the eurozone problems are not over and interest rates remain low.

Goldman Sachs offers accelerated exposure to international equities

US issuance shifts from domestic to international equities, while the participation rate for the latest Goldman Sachs offering hits three times the returns of the MSCI EAFE Index.

Small and mid-cap domestic equities on offer to US investors

While US equities continue to dominate the issuance, products have diversified into small and mid-cap indexes.

Domestic equities dominate index-linked issuance in US

US equities were the major theme in index-linked issuance at the end of last week, although diversification away from the S&P 500 was on offer from some providers.

Best in Spain

Best in Spain

Standard & Poor’s launches Covered Call Select Index

Standard & Poor’s launches covered call select index

FTSE Diversification index series as the 'way forward'

FTSE Diversification index series as the 'way forward'

Trade of the month: Digital payoffs

Digital options lead to two outcomes and are most commonly used with capital protected structured products.

ICFA talks Target2- Securities with the ECB

Jean-Michel Godeffroy, chairman of the T2S programme board at the European Central Bank, talks through the future of the settlement platform with Melanie White of ICFA Magazine

Tel Aviv Stock Exchange seeks to capitalise on Israel's 'developed market' status

A new phase for Tase

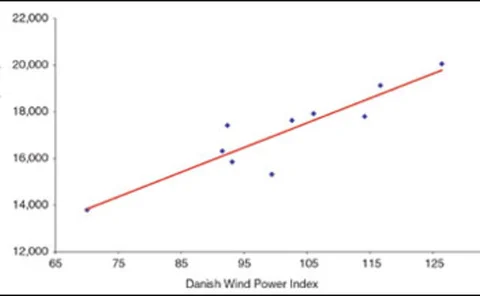

Marrying correlation and asset allocation

Coping with correlation

BNPP’s Deudon moves up and Delahaye steps in

Thibault Delahaye takes over equity derivatives trading at BNP Paribas as former head Eric Deudon is appointed to lead the newly created emerging markets division within equities and commodities.

Credit Suisse names Abbasi as new Asia chief exec

Credit Suisse names Abbasi as new Asia chief exec

EC looks to tackle unilateral approach to short selling

The EC’s new short-selling rules should reduce unco-ordinated action by national regulators, say dealers

Structural shifts in equity flows and ETFs force up correlation, says HSBC

HSBC's global report indicates that correlation in the global equities market has been steadily rising since 2001.

US Wrap: Wells Fargo offers accelerated US equity returns

Wells Fargo is the only issuer of publicly registered structured products in the US as volumes tail off

Credit Suisse launches AES velocity in Singapore allowing trades under one millisecond

Credit Suisse has launched an ultra-low latency direct market access speed that will give investors to trade Singapore-listed equities in under one millisecond.

Exchange-traded product volumes up 13% in 2010

Fixed-income exchange-traded products made money, investors turned to gold and a decline in assets followed falls in the equity markets in the first half of this year

HSBC survey: Hong Kong individuals most affluent in Asia

Hong Kong affluent individuals hold average liquid assets of $301,289, almost double Singapore’s at $183,145 and Taiwan’s at $155,162.