Energy trading

Seeking an end to manipulation

Renewed allegations of manipulation of natural gas pipeline capacity in the US have been partly blamed on regulatory complacency. How can regulators put an end to the problems dogging the gas markets? Catherine Lacoursière reports

Speculate away

A new report argues that speculative trading in the crude oil markets contributes far less to volatility than its critics suggest. Kevin Foster looks at the arguments

Carbon across Europe

Pan-European emissions trading is a step closer after agreement of an EU directive. Atle Christiansen and Kristian Tangen of Point Carbon look at the consequences

Models of good behaviour

The development of new models that describe the real dynamics of energy prices have to take into account the behavioural aspects of market players. The problem is how to quantify these aspects. Maria Kielmas reports

Pumping up prices

Gasoline prices in the US hit all-time highs in March, and the price is expected to remain high throughout the summer. Kevin Foster looks at the contributing factors

The return of Russian crude

Russia has reclaimed its position as the world’s biggest oil producer for the first time in a decade – but uncertainty is still preventing some foreign oil firms from making the investments the country needs to fulfil its potential. Kevin Foster reports

Seam shifts in central Europe

Gordon Feller looks at the changing coal economies of Bulgaria, the Czech Republic and Slovenia and the effect of electricity sector moves in the region

Online clearing: the shape of energy markets to come

The energy trading market is moving towards a structure in which participants achieve market presence through a dedicated market network, rather than having to use local or regional exchanges, says strategic consultant Chris Cook

Coal on the rocks

Faced with liquidity problems, falling volumes and uncertainty over the accuracy of price data, coal trading has had many of the same difficulties as the natural gas and power sectors over the past year. How can it get back on its feet, asks Kevin Foster

US gas market challenges

A new report from the investigative office of the Federal Energy Regulatory Commission finds that competitive natural gas markets in the US are robust, but warns of challenges ahead. Kevin Foster reports

In search of transparency

The open secret of index price manipulation in the natural gas sector is officially out, and the industry is scrambling to reform the system. Kevin Foster reports

El Paso helps RiskMetrics adapt

RiskMetrics Group, a company more often associated with the financial sector, is implementing its risk solution software at energy firm El Paso Corp. How is it adapting the software to the specifics of the energy sector? Kevin Foster reports

A safety net for energy traders

Will the Edison Electric Institute’s master netting agreement help reduce credit risk for energy traders? Kevin Foster takes a look at this new initiative

Fighting oil volatility

Oil cartel Opec froze its production output level at its last meeting in September. With war in Iraq on the cards, Shifa Rahman reports on the future of oil volatility

Cleaning up in California

As oil majors embrace the use of ethanol in Californian gasoline, analysts are warning that it will cause a rise in prices at the pump, as Kevin Foster discovers

Brent’s liquidity crisis

The decision by energy information provider Platts to alter the definition of its Brent benchmark price has forced the issue over the crude blend’s liquidity problems, reports Matt Horsbrugh

Banks take shelter in derivatives

While some banks have found the weather derivatives market a non-starter, others are doing deals worth more than $100 million. Eurof Thomas reports

Stand-off over hub plans

German firms Ruhrgas and BEB Erdgas & Erdöl and Norway’s Statoil say they want to work with Gasunie on developing the northwest European natural gas trading hub. Gasunie is making similar noises. So why the separate plans, asks Peter Joy

Airlines tackle price turbulence

Industry woes force airlines to get serious about improving efficiencies, including implementing new hedging and procurement tools, as Don Stowers discovers

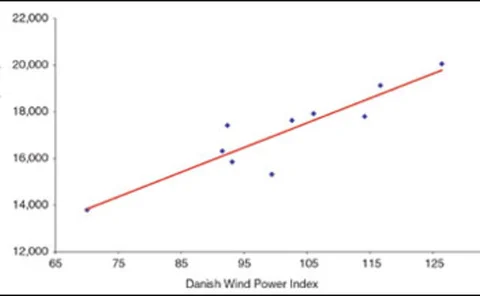

When the wind doesn’t blow

In light of the increased interest in investing in renewable energy following the publication of the EU renewables directive in September, David Pethick, Rebecca Calder and Chris Clancy suggest a method of reducing wind risk

LNG comes in from the cold

Will the current rise in activity in the liquefied natural gas industry result in the product being traded in the same way as other commodities? By Eurof Thomas