Electronic trading

OTC trading platform of the year: Trad-X

Risk Awards 2019: From a D2C Clob to CCP-specific pricing, Trad-X isn’t scared to rock the boat

Equities flow market-maker of the year: Citadel Securities

Risk Awards 2019: Risk management overhaul helps market-maker navigate February 5 volatility

Currency derivatives house of year: BNP Paribas

Risk Awards 2019: French bank hits options windfall in Turkey during currency crash

Streaming liquidity provider of the year: XTX Markets

Risk Awards 2019: Non-bank market-maker doubles direct relationship presence in forex

Rates flow market-maker of the year: LBBW

Risk Awards 2019: Landesbank uses e-trading – and Brexit – to boost its euro swap volumes, and its voice

BNPP targets US equities in new tie-up with GTS

French bank says derivatives business will benefit from better prices and liquidity in underlying stocks

Structured product platforms take off in Asia

Multi-dealer platforms Contineo and FinIQ seek to replicate success in Europe’s fragmented market

Jump: inside the secretive e-trading giant

Execs at the Chicago prop firm wish the whole world was a Clob, but as bilateral volumes rise, they’ve decided to go with the flow

Industry fears EU ‘Google tax’ will hit trading venues, CCPs

Broad wording of digital services tax could place market infrastructure in firing line

Sef reforms could distort new, sounder benchmark rates

Tradition’s Fitzpatrick warns that more ways of trading swaps could dent progress made on fixings

Off-the-run barriers frustrate Jump Trading

Chicago prop firm has been unable to break into the market for off-the-run Treasuries

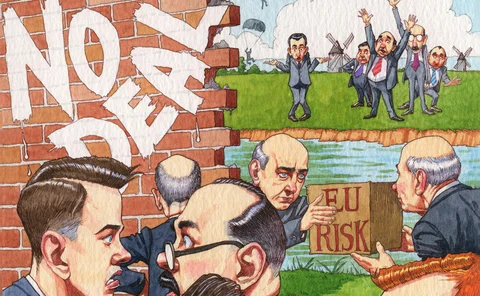

Day one of a no-deal Brexit: swaps and chaperones

Banks, trading platforms, repositories tee up EU entities – and dread the repapering crunch that would follow

Dealers sour on Mifid’s systematic internaliser label

SI decisions will take account of tougher pre-trade rules, client demand and Brexit

Direct streaming gains foothold in US Treasuries market

Cost savings drive dealers away from Clob model into alternative venues

Buy side using two-way prices in bid to hide trade intent

Number of trades done via ‘request-for-market’ protocol leaps 510% in past year

To Hull and back: a 20-year hiatus in bank e-trading plans

In the 1990s, banks tried to buy automated trading expertise; now, after a long break, they’re trying to build it

Machine earning: how tech is shaking up bank market-making

As banks get serious about e-trading, humans are being asked to give up their secrets to the machines that could replace them

Hunt for toxic flow hits one of banking’s old problems

Wider use of mark-out tools helps banks spot ‘bad’ trades – and also stirs debate on pay

‘People who bought this swap also bought Apple’

Dealers hope personalisation algos will help them cut sales costs, but data gaps could be a problem

Rise of the cyborgs: tech remakes the front office

Dealers “have no choice” but to change, says UBS’s Orcel – and plenty of changes are coming

trueEX sues 11 banks over swaps ‘conspiracy’

Platform alleges market-makers acted to preserve dominance of bank-owned Tradeweb

Asia Risk Interdealer Rankings 2018: The winners

Societe Generale and BGC top the tables

Planned sale prompts hard look at post-trade firms

Plans to sell MarkitServ fuel warnings about middleware vendors’ future

Buy side using compression tools to create, not destroy

Custom-trading services are booming at Bloomberg and Tradeweb, but not for the reasons intended