Electronic trading

Scrutiny and frictions follow EMS vendors into fixed income

Aggregators are facing resistance from venues and attracting the attention of regulators

Volatile FX markets reveal pitfalls of RFQ

Clients urged to mask trading intent; critics warn of subtle sell-side advantages

Electronic bond trading stalled in volatile markets

Bid/offer spreads on bond platforms spiked in March and the buy side struggled to trade

Ion rival TransFICC gets cash boost

HSBC, ING join £5.75m investment round, amid claims of shrinking tech choice

Ion’s wrists slapped in probe of Broadway deal

Competition watchdog extends initial investigation after Ion failed to comply with call for info

Fee fight: dealers take aim at brokerage costs

Old tensions have new edge as banks urge clients to bypass platforms

E-trading takes hold for FX swaps – sort of

Bulk of trades are being executed over screen, but bolder changes have stalled

Ion’s Broadway deal leaves banks in a bind

Barclays and Nomura among banks that had moved from Ion to rival it now controls

FX aggregators flirt with scrutiny over brokerage charges

Making dealers pay for trades raises ‘payment for order flow’ questions

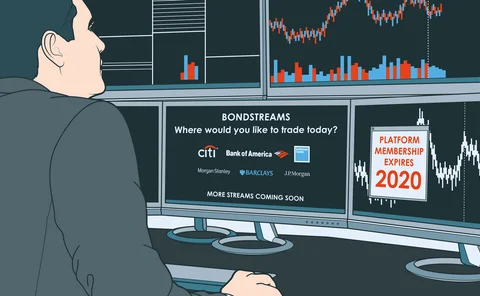

Full stream ahead for bonds

Price streaming offers cost savings and operational efficiencies, but it could fragment liquidity

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Interdealer broker of the year: BGC Partners

Risk Awards 2020: Strong voice revenues are helping fund ambitious electronic projects

OTC trading platform of the year: Tradeweb

Risk Awards 2020: To keep volumes growing, platform had to confront “incumbent’s dilemma”

Tradeweb’s IPO shows how OTC markets are changing

RFQ pioneer is embracing new protocols and liquidity providers in a bid to connect the OTC markets

Derivatives house of the year: Bank of America

Risk Awards 2020: New home in Paris has brought more European clients to the Street’s most consistent markets franchise

Innovation in execution: Morgan Stanley

Risk Awards 2020: Odd-lot bot handles almost half of bank’s credit trades

Currencies flow market-maker of the year: Credit Suisse

Risk Awards 2020: Swiss bank shows block trading can still compete in the age of the algo

Banks team up for ‘Ion replacement’ project

Consortium weighs building fixed income software in potential threat to Ion, the dominant vendor

At bounding MarketAxess platform, a new CRO parses risk

Clarity and communication are basics to Oliver Huggins at one of the biggest US bond platforms

Funds look to ‘retrain’ traders as automation takes hold

As technology reshapes markets, nearly a third of buy-side staff will need to gain new skills

Ice swap rate failure disrupts exotics desks

Dollar version of rate wasn’t published on nine out of 22 working days in August

SEC mulls extra scrutiny of US Treasuries trading venues

Roisman suggests US might apply full rigour of Reg ATS to non-exchange Treasuries platforms

Insight Investment wary of banks’ last-look claims

Buy side should “team up” in bid for more forex transparency, argues senior trader

Tradeweb reveals package trading for swaps and bonds

New tool offers pricing and trading of sterling swap-bond combo