Corporate bonds

Altman: mega-bankruptcy wave coming

Credit conditions were worsening before Covid, research finds

Volatility scaling flops in credit alt risk premia

Strategies miss recovery from March plunge, prompting rethink on speed of mean reversion

China bond buyers tiptoe through credit analysis minefield

State backing for domestic companies is hard to gauge, as new investors are discovering

CSDR buy-ins – next on the regulatory chopping block?

A big jump in trade fails is adding to doubts about the EU’s settlement discipline regime

Covid-19 chaos drains Axa’s Solvency II ratio

French insurer’s regulatory capital ratio is at its lowest since the Solvency II regime took effect

Electronic bond trading stalled in volatile markets

Bid/offer spreads on bond platforms spiked in March and the buy side struggled to trade

Bond managers relaxed ahead of bumper index rebalance

Fed’s credit facilities boost confidence as downgrades hit corporate bond indexes

Index delays leave passive bond funds in purgatory

Moves to postpone index rebalancings could backfire as rating agencies press ahead with downgrades

Corporates sprint to lock in low rates

Dealers are seeing increased demand for interest rate hedges despite higher execution costs

EU funds loaded up on US debt in 2019

Net purchases of US debt up +962% in 2019

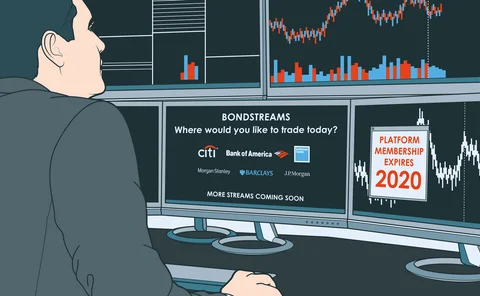

Full stream ahead for bonds

Price streaming offers cost savings and operational efficiencies, but it could fragment liquidity

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Tradeweb’s IPO shows how OTC markets are changing

RFQ pioneer is embracing new protocols and liquidity providers in a bid to connect the OTC markets

Innovation in execution: Morgan Stanley

Risk Awards 2020: Odd-lot bot handles almost half of bank’s credit trades

Low investment grade debt a staple of EU insurer portfolios

Debt holdings just one notch above junk status make up €642.8 billion of standard formula insurer assets

Fed underscores run risk of corporate bond funds

Total AUM of junk bond and bank loan funds was around $350 billion in Q2 2019

Navigating the impact of climate risk on financial stability

As uncertainty abounds on the impact climate change may have on the industry, financial services firms must best equip themselves for potential regulatory and socioeconomic changes to ensure they maximise the opportunities of embracing new best practices…

Best CVA practices in Japan

At a recent roundtable in Tokyo, banks and regulators discussed progress on credit valuation adjustment (CVA). While, in many respects, the work towards implementing best practices in the country is on track, challenges remain in resourcing and…

At bounding MarketAxess platform, a new CRO parses risk

Clarity and communication are basics to Oliver Huggins at one of the biggest US bond platforms

Insurers slow purchases of eurozone sovereign bonds

Annualised growth rate of government debt holdings falls to 2%

Generali pivots from corporate bonds

Company debt makes up 31.6% of life insurance investment portfolio; 28.1% of property and casualty portfolio

Ties between EU insurers and banks vary by country

Estonian, Cypriot and Swedish insurers most exposed to banking sector

DTCC in talks to clear MarketAxess bond trades

Market-first move could cut platform’s costs and counterparty risks

Ice creates daily credit risk monitoring tool

Company muscles into Bloomberg’s fixed income data territory with bond analytics service