Climate change

Tail sensitivity of stocks to carbon risk: a sectoral analysis

The authors investigate the tail sensitivity of US industry returns in relation to changes of carbon-driven climate risk, finding that tail sensitivities rise with the greenhouse has emissions of an industry.

The role of a green factor in stock prices: when Fama and French go green

The authors propose a means to capture climate change risk exposure by combining a green factor with typical frameworks used for explaining stock returns.

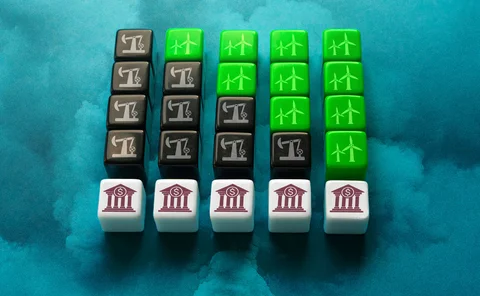

How to account for banks’ contribution to CO2 emissions

Price adjustments will depend on individual counterparties’ carbon footprints

UN climate risk chief calls for shorter-term stress tests

But banks say heavy modelling demands will take time to respond to adequately

Estimating the impact of climate change on credit risk

The author investigates the relationship between climate change and credit risk characteristics of individual obligors and portfolios of credit obligations.

The evolution of buy-side risk: managing the emerging importance of liquidity and climate risk

Risk managers have a tried and tested toolkit for market risk, but recent events and developments have highlighted the need for increasing rigour around liquidity risk and climate risk. This webinar explores the evolving scope of buy-side risk management…

Q&A: The evolution of climate risk assessment

Prerna Divecha of S&P Global Market Intelligence discusses the changing requirements for financial institutions in developing a robust and comprehensive view of climate risk

Social distancing: quantifying the ‘S’ in ESG

The ‘social’ pillar of ESG has been the poor relation in terms of data – until now

Banks begin tackling climate stress tests of trading books

Market risk professionals see major shortcomings in available scenarios

Climate risk models and metrics: what works and what doesn’t?

Panellists at Risk Live Europe 2023 discussed what has been achieved so far in climate risk stress-testing and modelling, alongside what needs tackling next

360° of climate: indexes for every objective

This white paper explores climate strategies targeting objectives – including low carbon, fossil fuel-free and net zero – to help investors respond to the risks and opportunities of the climate challenge

Risk managers mull Basel-style climate standards

Risk Live: Splintered approach to stress-testing across jurisdictions “very, very worrying”, says risk expert

HKMA launches consultation on green taxonomy

Regulator could use proposal to assess progress of banks towards climate goals

Climate risk: a more positive approach pays dividends

As the world grapples with the impacts of climate change, organisations are racing to keep up with new ESG disclosure requirements and climate risk analysis methodologies. But what separates those ahead of the curve from those that are lagging? The…

Basel climate guidance leaves op risk managers in the dark

Banks still unclear on how to fit climate events into existing capital framework

Incorporating climate risk into ALM frameworks at banks

In this webinar convened by Risk.net in collaboration with SS&C Algorithmics, experts discuss the challenges and benefits of incorporating climate risk into asset-liability management frameworks at banks

The carbon equivalence principle: methods for project finance

A method to price the environmental impact of financial products is proposed

Fed’s climate stress test whips up storm for banks

Long-awaited US climate risk exercise puts tough pressure on banks’ data and models

Climate-policy-relevant sectors and credit risk

This paper explores the relationship between banks exposed to climate-policy-relevant sectors and credit risk, finding that banks exposed to higher carbon emitting sectors are subject to greater credit risk than those exposed to less carbon emitting…

Top 10 operational risks for 2023

The biggest op risks for the year ahead, as chosen by senior industry practitioners

Risk.net’s top 10 investment risks for 2023

Geopolitical frictions, sticky inflation and a hard landing are among the hazards cited by investors

ESG: the new risk factor in your portfolio

Risk officers, managers and quants at leading buy-side firms are experimenting with ESG as an ‘alpha enhancement’ to day-to-day risk management, to stay ahead of the pack and boost profit-and-loss margins

HKMA preparing prescriptive climate stress test for 2023

Regulator plans granular scenario specifications, considers Pillar 2 capital measures

FSB: third of climate stress tests not tackling physical risk

Six jurisdictions conducted exercises only for transition risk