Climate change

Risk.net’s top 10 investment risks for 2025

Fresh concerns this year include a trade war, a stock market crash and growing social discord

Thirteen EU banks face loan losses of more than 16% from green switch

Climate stress test predicts overall bank losses of 6%, rising to 11% under adverse scenarios

Acadian model detects gaps between climate goals and reality

Quant shop builds tool for net-zero alignment assessment, using NLP and Bayesian models

New climate inputs upset Commerz’s loan risk map

Integration of sustainability parameters into provision models shifts €16 billion of loans to stage 2

Man Group airs climate allocation tool for real-world decarbonisation

Compass is a guide for steering $200 trillion investment toward decarbonising high-emission industries

Physical climate risk threatens 15% of EU banks’ property loans

Erste, Helaba, BPCE most exposed to chronic and acute risks linked to climate change

GAR coverage misreporting widespread among top EU banks

Sabadell, OTB rectify reporting errors; Helaba backtracks to incorrect method

Climate stress tests are cold comfort for banks

Flaws in regulators’ methodology for gauging financial impact of climate change undermine transition efforts, argues modelling expert

Integrating climate into market and credit risk frameworks: what’s next?

A webinar on climate risk, discussing how and why it needs to be integrated into short-term risk assessments

US banks seek to open vendors’ black box on green data

Inaugural Fed climate scenario analysis flags lack of transparency around third-party models

False start: 13 EU banks miscalculate new GAR coverage metric

Unclear instructions, late guidance and poor font choices among reasons behind diverging interpretations from EBA’s template

First green asset ratios come in low as EU banks protest methodology

ABN Amro only bank to break double digits in a sample of 23 lenders

EU banks fear green asset ratios paint an unfair picture

Industry lobbyist clashes with lawmaker over usefulness of new sustainability disclosure

Hot topic: SEC climate disclosure rule divides industry

Proposal likely to flounder on First Amendment concerns, lawyers believe

Tall order: why a unified op risk taxonomy is still elusive

Banks vary in how they classify operational risk losses – and regulators are in no rush to change the status quo

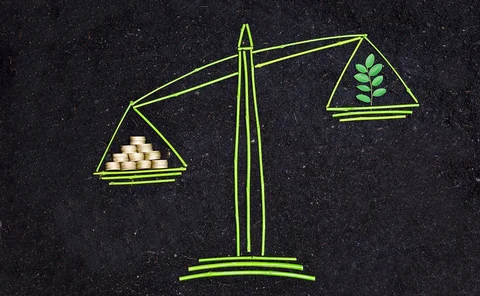

The carbon equivalence principle: minimising the cost to carbon net zero

A method to align incentives with sustainability in financial markets is introduced

Navigating technology integration in an altered buy-side risk landscape

Luke Armstrong discusses the expanding role of buy-side risk teams, the comprehensive integration of risk factors and how technology can help risk managers navigate a dynamically shifting risk landscape

Growing regulatory focus fuels climate risk staffing fight

Widespread poaching as banks find repurposing existing quants may not provide the right expertise

US climate guidance stokes debate over defining material risks

Banks welcome flexibility, but it could lead to big divergence on climate risk management

Quant shop preps NLP-powered index for physical climate risk

Sharp rise in extreme weather events prompts PGIM Quant to aim for better climate-risk pricing

Climate capital in the balance as EBA rejects green risk weights

European regulator suggests climate change must be factored into existing risk categories

Assessing the importance of liquidity and climate risk in an evolving risk landscape

In a Risk.net webinar sponsored by S&P Global Market Intelligence, five experts discussed the challenges that evolving risks pose and how the buy side is having to adapt its approach. This article examines the key themes that emerged from that discussion

Climate risk overlays unnerve model-validation teams

Risk Live: Model risk managers fear they lack the data or skills to properly test expert judgement

Degree of influence 2023: Quants thrive on volatility

Climate, crypto and market impact also featured among the top research topics in 2023