Clearing

Ice considers moving Brent contract to avoid EU margin hike

Ice says move is “not an outcome we want to see” but Emir margin could drive users away

Equity swaps clearing plans divide industry

Moves by CCPs to clear equity swaps leave market deeply divided

CCPs urged to coordinate on default management

Regulators may need to provide a framework for CCP interaction

In-depth introduction: Clearing incentives

Price hikes at Goldman Sachs show how much pressure FCMs are under

Nouy: Europe should keep 3% leverage ratio

SSM chair also wants to end rule opt-outs that make banks "look stronger than they really are"

High KRX clearing fees driving won swaps offshore: Bank of Korea

Central bank says dealers are moving trades offshore to avoid KRX's high cost

China's clearing and reporting regimes being built bottom-up

But reported problems include disclosure of state secrets stopping US trading

Unclear incentives: do capital and margin rules support CCPs?

Regulators see incentives to use cleared swaps; critics claim analysis is flawed

EBA warns banks to correct pension fund CVA ‘mistake’

Clearing test has to be met for CVA safe harbour to apply, lawyers say

CCPs raise alarm on South African OTC reform

Push for CCPs to establish domestic presence riles LCH and CME

Pension funds sign hedge-only agreements with banks

Cardano and PGGM promise not to give banks speculative trades

Calypso Technology: No FCM, no problem

Ex-RBS clearing head maps out a world without FCMs

Metals traders shun clearing due to Emir, says LME chief

Emir segregated accounts pushing firms to trade OTC, says Jones

Banks blame regulation for FCA's clearing worries

UK regulator warns client clearing could become a “missing market” but defers study

JP Morgan warns on swaps clearing

Bank says client clearing returns are "incompatible" with current capital rules

Call for user-owned utilities to lower central clearing cost

But monopoly or duopoly inefficient, BNY Mellon says

Clearing houses face privacy law concerns

US reporting requirements could force CCPs to break national privacy laws

UBS takes Sfr4.2bn of client collateral off balance sheet

Accounting change cuts futures clearing leverage exposure

Massad backs leverage ratio changes

CFTC chairman “very concerned” about negative impact on clearing

Traiana drama culminates in CEO’s exit

Senior executives butted heads, but CMO ousts CEO in latest twist

House committee calls on Fed to change leverage ratio

US politicians argue "unwarranted" capital burden will hike end-user costs

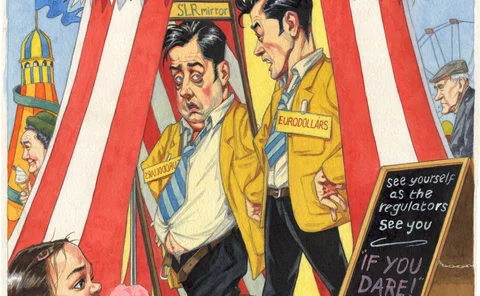

The invisible incentives of clearing

Leverage ratio is making life difficult for clearing's gatekeepers

Leverage ratio threat to Eurodollar liquidity

Cost of benchmark contract will rise and liquidity will fall, clearers warn

CME fears futures clearing retreat

Leverage ratio could prompt FCMs to be more picky, warns CME's Sprague