CCP

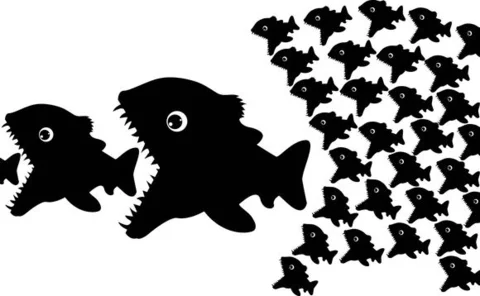

WHAT IS THIS? A central counterparty (CCP) manages default risk by collecting initial and variation margin from both parties to a trade. Spill-over losses are absorbed via a default fund to which all members contribute – introducing a degree of mutualised risk – and by the CCP’s own capital. The concept is an old one that was extended to over-the-counter derivatives in the aftermath of the financial crisis.

OTC Derivatives Clearing Summit: Some FCMs charging five times more than others, says panel

Fees charged by clearing members can vary wildly – and low-cost providers may try to terminate relationships if they prove unprofitable, panellists warn

OTC Derivatives Clearing Summit: Buy side bemoans ‘lowest common denominator’ treatment

Pension and insurance firms complain CCPs treat them the same as hedge funds

OTC Derivatives Clearing Summit: Joint solution needed on intraday margin calls, says panel

Dealers, clients and clearing houses need to work together to resolve problems caused by intraday margin calls, say panellists

OTC Derivatives Clearing Summit: Nearly a third of uncleared CDS are clearing-eligible

SEC study finds large portion of clearing-eligible CDS still trading bilaterally

OTC Derivatives Clearing Summit: Industry will struggle to meet clearing deadlines

Buy-side firms will struggle to finish legal and operational work ahead of US mandated clearing deadlines – and they are not the only ones, says panel

European OTC clearing documentation faces delay

Complications over close-out mechanisms and segregation models will delay the European addendum by up to three months, say dealers

Unclear on clearing in Germany

Unclear on clearing

What will clearing cost?

What will clearing cost?

Neal Wolkoff: OTC market faces break-up blues

Break-up blues

Regulation to hit bank profitability - Risk survey

Dealers expect new rules to hit the profitability of their business, but fewer expect to be able to pass the costs along – and more are anticipating a big drop in OTC trading volumes

Industry slams 'unworkable' Esma proposals on indirect clearing

Clearing members would be forced to guarantee trades executed by their clients' clients - on terms the member firms have not agreed

LCH.Clearnet model ‘not appropriate’ for Australian market, say two domestic banks

Two Australian banks speaking at Risk & Return Australia are critical of LCH.Clearnet for not meeting local market needs with its central clearing operation

LCH readies launch of new NDF pairs and client clearing

Five months after launch, ForexClear is ready to start offering client clearing and to add five new currencies to the service, pending the approval of the FSA and the CFTC

Acclaimed new TriOptima service may not have a future

In the balance?

Central banks working on liquidity support for CCPs, says BoE’s Tucker

International regulators and central banks trying to avoid "nightmare" of fragmented clearing system

Risk 25: The search for margin efficiency

Margin efficiency: The new battleground

Risk 25 firms of the future: Introduction

With over-the-counter derivatives markets in flux, picking winners and losers is a tough job. This is where Risk’s editorial team nails its colours to the mast. By Lukas Becker, Matt Cameron, Laurie Carver, Clive Davidson, Ramya Jaidev, Peter Madigan,…

Risk 25 firms of the future: State Street

Taking on the Street

Risk 25 firms of the future: Newedge

'Fair and unconflicted' but under pressure

Risk 25 firms of the future: Deutsche Bank

Difficult choices ahead

Risk 25 firms of the future: Citadel

OTC market-maker in waiting

Risk 25 firms of the future: BlackRock

‘Jury out’ on OTC derivatives