CCP

WHAT IS THIS? A central counterparty (CCP) manages default risk by collecting initial and variation margin from both parties to a trade. Spill-over losses are absorbed via a default fund to which all members contribute – introducing a degree of mutualised risk – and by the CCP’s own capital. The concept is an old one that was extended to over-the-counter derivatives in the aftermath of the financial crisis.

Basel will address leverage ratio threat to clearing

FAQ document to tackle treatment of segregated initial margin

Pension funds sign hedge-only agreements with banks

Cardano and PGGM promise not to give banks speculative trades

Calypso Technology: No FCM, no problem

Ex-RBS clearing head maps out a world without FCMs

CCP debate needs to go beyond skin in the game

Discussion needs to move on to how to keep markets functioning in a default

Banks blame regulation for FCA's clearing worries

UK regulator warns client clearing could become a “missing market” but defers study

Basel III transforming securities lending market

New entrants respond to challenges facing primes and lenders

Call for user-owned utilities to lower central clearing cost

But monopoly or duopoly inefficient, BNY Mellon says

Clearing houses face privacy law concerns

US reporting requirements could force CCPs to break national privacy laws

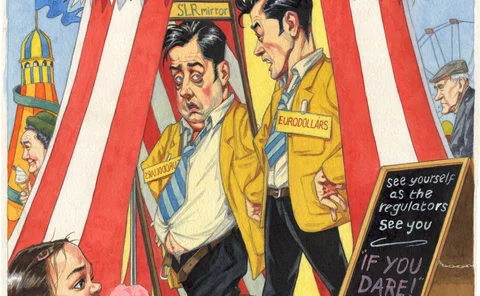

The invisible incentives of clearing

Leverage ratio is making life difficult for clearing's gatekeepers

Leverage ratio threat to Eurodollar liquidity

Cost of benchmark contract will rise and liquidity will fall, clearers warn

CME fears futures clearing retreat

Leverage ratio could prompt FCMs to be more picky, warns CME's Sprague

CME and LCH.Clearnet prep buy-side repo clearing

New clearing services could offer cross-margining benefits

India commodity exchange fights single CCP proposal

NCDEX finds itself in conflict with government clearing house proposals

CCPs confront the difficult maths of default management

The next time a big dealer defaults, it will hit a host of swap clearing houses simultaneously

Law firm of the year: Linklaters

Risk Awards 2015: CoCos and Co-Op were big wins for UK firm

DBS risk chief calls for wider margining exemption for non-banks

Margining rules for uncleared derivatives will be a drain on liquidity

CFTC to simplify route for clearing houses to be exempt DCOs

US regulator will pursue a quicker route to exempt foreign CCPs

Ice hits out at LCH over capital resistance

CCPs shouldn't fight calls for extra capital, says Sprecher

Six open to acquisitions to expand outside Switzerland

Stock exchange group has “excess cash”, says group CEO

CFTC's Massad muddies waters in CCP oversight row

Dual registration – not deference – is "proper model" for supervision, says CFTC chair

New frontloading threshold stirs up MEPs

"Hard to see" how plans honour EC pledge to avoid harm, says Swinburne

GCSA Capital: the CCP underwriter

A consortium of 25 insurers is offering to cover CCP tail risk

CDS clearing – The looming mandate

Sponsored Q&A: LCH Clearnet

Risk Italia survey 2014: Regulation brings clearing to the fore

Derivatives activity in the Italian market at a relatively steady state – especially considering tough economic conditions