Asset-backed securities (ABSs)

Large hedge funds highly exposed to asset-backed securities

Biggest funds also exposed to US junk corporate debt

Q&A: Benoît Coeuré, ECB, on securitisation and clearing risks

Revamped ABS market will need state support if it is to be a game-changer for Europe

ECB’s Coeuré: Europe faces ‘fundamental choice’ over ABS

High-quality ABS will need some form of public backing to reach potential

Bond repack capabilities – Simplicity, security, independence

Sponsored video: Societe Generale

Positive MBS momentum from R&W settlement trades

Legacy non-agency market benefits from anticipated payouts

ECB calls for lighter treatment of high-quality ABS

Bank of England and ECB to promote coherent approach to ABS regulation

SEC names new chief of enforcement unit

New lead for SEC's complex financial instruments unit

New Solvency II capital charges still threat to ABS demand

European insurer demand for debt securitisations could vanish despite proposals for lower capital charges

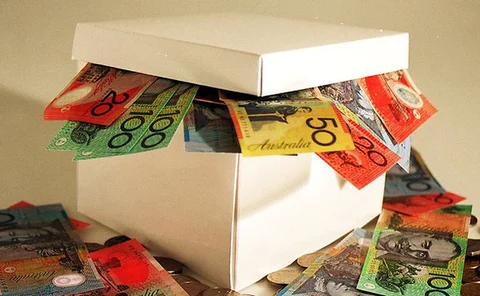

Bank funding options increased under revised Australian securitisation framework

Increased funding options welcomed in the face of a potential spike in Australia consumer credit growth

Chinese securitisation market risks fragmentation under current dual framework

The existence of multiple rule books may deter issuers and investors in securitisation

Insurers developing internal model risk calibrations for non-standard credit assets

Underlines growing strategic importance of infrastructure bonds and MBS, finds survey

Global Emerging Markets & Macro Fund (Gemm): BTG Pactual Global Asset Management

13th Annual European Single Manager Awards 2013

Collateral damage: Capital proposals threaten Europe's ABS market

Insecuritisation

Banks push alternative to Basel Committee securitisation model

Basel proposals would kill European market, banks warn – and some regulators sympathise

Insurers to target export finance loans as banks withdraw

Sovereign-guaranteed loans provide yield boost for insurers

STS Partners Fund: Deer Park Road Corporation

Americas Awards 2012

Reviving securitisation: regulators send mixed messages

Reviving securitisation

Tullett Prebon and Allianz to launch Solvency II data service

Benchmark OTC curves 'will help insurers calculate risk data for market risk models'

Stress test struggle: separating liquidity and market risks

Stress test struggle

Lifetime achievement award: Lance Uggla

Risk awards 2012

Basel 2.5 prompts flurry of asset sales and risk transfer deals

The profits of imbalance

Is asset-backed credit support an option for energy firms?

Coming up with the money

Basel 2.5: regulators still wrestling with Dodd-Frank clash

Barriers to Basel