Artificial intelligence

Allianz Global Investors adopts NLP signals in equities

Move to tackle unstructured data starts with sell-side analyst reports

Deploying agile analytics in the fight against fraud

Financial firms are under pressure to tackle the widespread problem of financial fraud. As the speed, scale and sophistication of fraudulent activity grows, a panel of financial crime experts reveal how firms can develop an agile analytics capability to…

Harnessing AI to achieve Libor transition

Chris Dias, principal at KPMG, explains how the vast increase in accuracy that artificial intelligence (AI) offers when dealing with large volumes of complex agreements is crucial to exploring the market opportunities and mitigating the risks of the…

Machine learning, Deutsche auction and repo haircuts

The week on Risk.net, September 14–20, 2019

Some quant shops doomed to ‘struggle’ – López de Prado

Theory-first firms must modernise their methods or wither, says machine learning expert

ETF provider of the year: Yuanta SITC

Asia Risk Awards 2019

NLP sniffs out contracts harbouring Eonia as fallback

Test finds wide range of 4,000 Libor euro contracts examined could end up in the flagging Eonia rate

Goldman improves execution ‘by 50%’ with new algos

Bank uses neural networks and other AI tools to cut slippage in stock trading

The machines are coming for your pricing models

Deep learning is opening up new frontiers in financial engineering and risk management

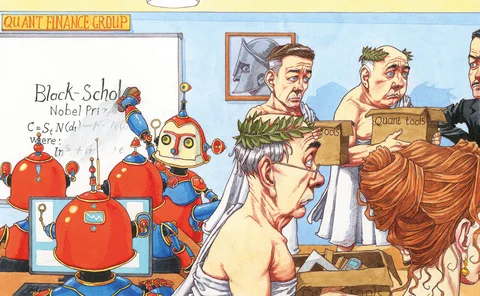

The rise of the robot quant

The latest big idea in machine learning is to automate the drudge work in model-building for quants

Margin reform – From challenge to opportunity

SmartStream Technologies explores how, as new initial margin regulations from the Basel Committee on Banking Supervision and the International Organisation of Securities Commissions become a pressing concern for more firms, technology service providers…

Deep hedging and the end of the Black-Scholes era

Quants are embracing the idea of ‘model free’ pricing and hedging

AllianceBernstein uses AI to sidestep ‘growth trap’

Random forest model aims to sort success stories like Amazon and Netflix from fast-growth losers

Finra plans machine learning push against market rigging

ML trained to find spoofing and layering

PanAgora uses NLP to cut through Chinese cyber speak

Fund builds Mandarin-reading algo to gauge sentiment of retail investors

Risk Technology Awards 2019: Making machines more helpful

Machine learning can be too efficient; now, vendors are looking for ways to make it more accurate. Clive Davidson looks at the stories behind this year’s Risk Technology Awards

How AI could tear up risk modelling canon

BlackRock, MSCI, LFIS among firms looking to replace traditional, linear risk models

A tech-driven transformation

A panel of experts explores how greater collaboration between risk and finance teams can garner significant benefits and add value, how technological innovation is making the regulatory landscape more complicated to navigate and produce transformative…

Model risk management transformation

Financial institutions have been maturing their approaches to MRM and – as models become more complex and pervasive, and regulatory expectations continue to increase – leading financial institutions seek faster and further movement. Ashutosh Nawani, head…

JP Morgan’s Hudson: innovation stuck in trading web

Risk Live: Digital head floats shared platform, rather than “point solutions”

Risk premia strategies – Lessons learned for the future

After a difficult 2018, investors are increasingly wary of risk premia, concerned that factors leading to underperformance might be a recurring problem. Imene Moussa, executive director at UBS, clarifies this issue

UBS unleashes Orca for rates clients

Machine learning algo trawls liquidity pools to slash US Treasury trading costs