Arbitrage

US branches of foreign banks shed $91 billion of reserves in 2018

Drop-off coincides with Fed’s ‘normalisation’ strategy

The credit skew market’s surprise package

Mediobanca’s €1.6 billion in issuance makes small Italian investment bank a market titan

US banks boost sales of CDS, reversing two-year trend

BofA Securities increased CDS notionals the most, adding $30.3 billion to its portfolio

Calling out autocallable pricing

Quants show popular autocallable pricing technique has a flaw that has been ignored until now

Base metals house of the year, Asia: BOCI

Energy Risk Asia awards, 2018: Chinese expertise enables BOCI to attract base metals business in Asia and beyond

Passive funds turn predator in pursuit of pricing edge

State Street, Amundi, HSBC sharpen trading tactics to exploit index changes

Hedge funds cut CDS positions as basis trades diminish

Net long CDS positions fell by $117 billion from mid-2014 to end-2017

Podcast: Roos on swaptions arbitrage and benchmark reform

Benchmark reform means additional work for rates quants

LCH-JSCC basis drops as hedge funds arrive

Capula and Rokos Capital among funds to have gained access to JSCC in recent months

Cash no longer king in European swaptions

Barclays executives explore weaknesses of current pricing formulas for cash-settled swaptions

Falling margins force energy firms to expand data use

Verification and model challenges arise as volatility and margins dry up

Best specialist sub-$250m FoHF over 15 years: Culross Arbitrage Fund (Culross Global Investment Management)

Imperfect markets create opportunities for Culross, played out through different themes

BIS’s Shin links dollar strength to global malaise

Framework could answer many questions economists have struggled with in recent years

Auditors: the extra line of defence

If CDS skew spikes, some banks may be thankful for conservative accountants

Skewed views: banks, auditors split on CDS index trades

Views on risks and accounting treatment of arbitrage repack differ across the Street

Finite difference techniques for arbitrage-free SABR

This paper applies a variety of second-order finite difference schemes to the SABR arbitrage-free density problem and explores alternative formulations.

Basel arbitrage warning leaves dealers guessing

Banks told to avoid trades that offset regulatory adjustments, but details are thin

Eurekahedge data on individual fund performance – November 2015

The latest statistical information on top-performing FoHFs and hedge funds

Mariner Coria: the changing face of arbitrage

Fund manager exploits mispricings linked to structured products and derivatives end-user flows

Economists, like hedge fund traders, need open minds

Economists, risk managers and traders must learn the lessons of crisis, says Kaminski

Pension fund risk manager of the year: PKA

Risk Awards 2015: So smart, banks will pay to do business with Danish fund

FSB warns of spillovers from new bank structures

Some jurisdictions fear unintended consequences of reforms

Sympathy for the arbitrageur

Life has become more difficult for arbitrageurs - and other market participants should care

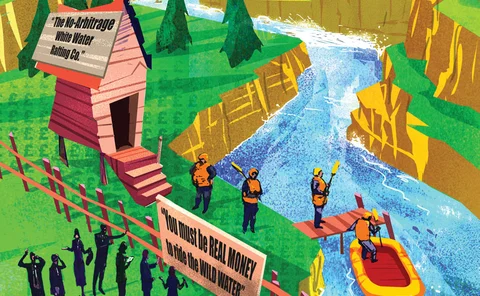

No arbitrage: New rules make markets 'less efficient'

Indexes may be less effective hedges in absence of arbitrageurs