Technical paper

The stochastic-volatility, jump-diffusion optimal portfolio problem with jumps in returns and volatility

The risk-averse optimal portfolio problem is treated with consumption in continuous time for a stochastic jump-volatility-jump-diffusion (SJVJD) model for both the risky asset and the volatility.

The impact of retail payment innovations on cash usage

This study examines the effect of retail payment innovations on the use of cash at the point of sale.

Quantifying irrational sentiment

The author uses behavioral finance theory to create a measure that detects when stock markets become irrational.

Analysis of the use and impact of limits

In this paper, we analyze the use and impact of limits in TARGET2. Limits in the form of bilateral or multilateral debit limits are a liquidity management feature in TARGET2.

Hedging iTraxx credit default swap index trading on an intraday basis: an empirical study

In this paper we examine the effectiveness of intraday hedging models for credit default swap index trading by means of more liquidly traded exchange-based futures contracts.

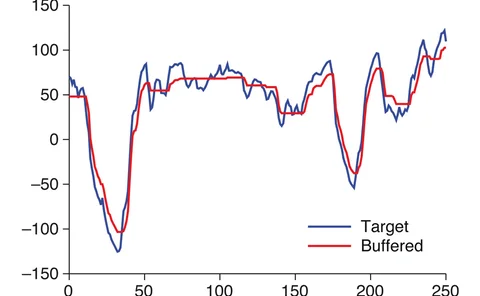

Momentum strategies with the L1 filter

We discuss various implementations of L1 filtering in order to detect some properties of noisy signals.

Short-rate joint-measure models

A joint-measure model combining Q-measure and P-measure

Path-dependent volatility

Julien Guyon on path-dependent volatility models

A Fourier approach to the computation of conditional value-at-risk and optimized certainty equivalents

We consider the class of risk measures associated with optimized certainty equivalents.

Suitability of capital allocations for performance measurement

Capital allocation principles are used in various contexts in which the risk capital or the cost of an aggregate position has to be allocated between its constituent parts.

Modeling a risk-based criterion for a portfolio with options

The presence of options in a portfolio fundamentally alters the portfolio's risk and return profiles when compared with an all-equity portfolio. In this paper, we advocate modeling a risk-based criterion for optioned portfolio selection and rebalancing…

General covariance, the spectrum of Riemannium and a stress test calculation formula

This paper proposes a formula for a market stress test of a portfolio.

Credit exposure models backtesting for Basel III

The Basel Committee on Banking Supervision has introduced strict regulatory guidance on how to validate and backtest internal model methods for credit exposure. Fabrizio Anfuso, Dimitrios Karyampas and Andreas Nawroth incorporate these guidelines into a…

Regulatory costs break risk neutrality

Regulations impose idiosyncratic capital and funding costs for holding derivatives. Idiosyncratic costs mean that no single measure makes derivatives martingales for all market participants. Chris Kenyon and Andrew Green demonstrate that regulatory…

Cutting edge: Incorporating forex volatility into commodity spread option pricing

Spread option pricing: importance of forex risk factors illustrated

Optimal trading under proportional transaction costs

A universal law for optimally dealing with proportional transaction costs

Cutting Edge intro: maths versus machine

Banks can use maths - rather than special chips - to boost computing speed

Optimal trading under proportional transaction costs

The theory of optimal trading under proportional transaction costs has been considered from a variety of perspectives. In this paper, Richard Martin shows that all results can be interpreted using a universal law through trading algorithm design

Adjoint credit risk management

Adjoint algorithmic differentiation is one of the principal innovations in risk management in recent times. Luca Capriotti and Jacky Lee show how this technique can be used to compute real-time risk for credit products, even those valued with fast semi…