Technical paper

Woolwich Plan Managers

Quant analysis by StructuredRetailProducts.com

Quant analysis by StructuredRetailProducts.com

Quant analysis

BNL Vita

Quant analysis by StructuredRetailProducts.com

La Poste

Quant analysis by StructuredRetailProducts.com

Broadening horizons

When the investment horizon is of the order of a few years, such as in the context of personalfinancial planning, it becomes necessary to calculate and stress-test the exact distribution ofthe market at the given horizon, as the common first-order…

Excess yields in bond hedging

Litterman & Scheinkman (1991) showed that the term structure of interest rates is reliablymodelled by an affine three-factor model using principal component analysis. Such a modelis inconsistent with no arbitrage. Here, Haim Reisman and Gady Zohar derive…

Caring competition

What are the theoretical consequences of restructuring electricity markets on emissions? Here, Benoît Sévi shows that changes in supply and consumption and restructuring for competition has environmental effects, and argues that strong public policies…

Citigroup

Quant analysis by StructuredRetailProducts.com

Quant analysis by StructuredRetailProducts.com

Quant analysis

BNP Paribas

Quant analysis by StructuredRetailProducts.com

Mediolanum Vita

Quant analysis by StructuredRetailProducts.com

Banco Sabadell

Quant analysis by StructuredRetailProducts.com

Monthly snapshot

market data

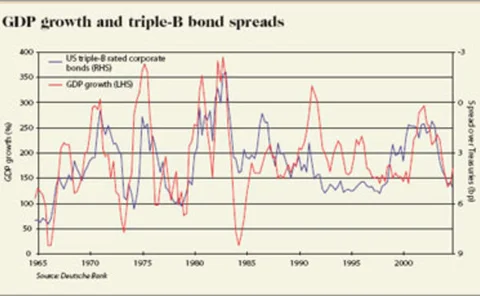

Triple-B tie-up

technical

Detecting market abuse

Financial regulators need a way to detect market abuse in real time. Marcello Minenna has developed such a procedure that can detect, for each quoted stock and on a daily basis, the presence of market abuse phenomena by means of a set of tripwires that…

Maximum likelihood estimate of default correlations

Estimating asset correlations is difficult in practice since there is little available data andmany parameters have to be found. Paul Demey, Jean-Frédéric Jouanin, Céline Roget andThierry Roncalli present a tractable version of the multi-factor Merton…

Mixed default modelling

Structural and reduced-form models are two well-established approaches to modelling afirm’s default risk. Here, Li Chen, Damir Filipovic/ and Vincent Poor develop a new default riskmodelling strategy based on combining these two frameworks in order to…

Incorporating policyholder expectations into ALM

European life insurers have recently improved their asset/liability management (ALM) skills.However, those efforts have been limited to the matching of guaranteed policyholder benefits.While bringing considerable insight, they also leave management with…

Ex-citations

Oil

Quant analysis by StructuredRetailProducts.com

Quant analysis