Risk-neutral modelling

The relative entropy of expectation and price

The replacement of risk-neutral pricing with entropic risk optimisation

Deep hedging: learning to remove the drift

Removing arbitrage opportunities from simulated data used for training makes deep hedging more robust

Union beckons for the three quant tribes

Studies may be deferred, but future for grads is bright, argues UBS’s Gordon Lee

Risk-neutral densities: advanced methods of estimating nonnormal options underlying asset prices and returns

This work expands the analysis in Cooper (1999) and Santos and Guerra (2014), and the performance of the nonstructural models in estimating the "true" RNDs was measured through a process that generates "true" RNDs that are closer to reality, due to the…

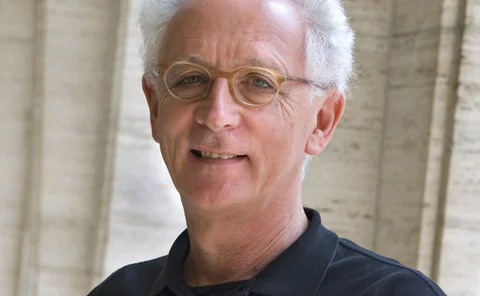

Podcast: Princeton’s Carmona on the future of quant education

Course director discusses machine learning explainability and reclaiming game theory from economists

Time to move on from risk-neutral valuation?

Risk-neutral valuation could be replaced by models with a subjectivity element, writes mathematical finance head

Two measures for the price of one

Harvey Stein combines risk-neutral and real-world measures into risk methodology

Short-rate joint-measure models

A joint-measure model combining Q-measure and P-measure

Regulatory-optimal funding

A treasury viewpoint on the funding optimization problem

In defence of FVA – a response to Hull and White

In defence of FVA

Traders close ranks against FVA critics

Traders v. theorists

Putting the fun in funding valuation adjustment

The fun of FVA

Cooking with collateral

Cooking with collateral

Eurostoxx 50 investors 'unintentionally making a bet on financials', according to research

Tobam's analysis of financial markets diversification suggests that eurozone indexes might not be as diversified as investors believe

Trees from history

Option pricing

Risk and probability measures

Although its drawbacks are well known, VAR has become institutionalised as the market risk measure of choice among trading firms and regulators. Now there is a growing feeling that a reappraisal is overdue, exemplified here by Phelim Boyle, Tak Kuen Siu…

Modelling credit migration

Masterclass – with JP Morgan

The tree of knowledge

Options