Operational risk

Relating specifics to the holistic

Op Risk Data Special Focus

Changing hats

Management Intelligence

Celent highlights reporting challenges

Management Intelligence

The search for a perfect fit

The Perfect Fit Technology

Briefs

Regulatory Update

AIG to form cross-border op risk sub-group

Regulatory Update

Basel Committee delays AMA

Front Page News

Federal Reserve and BIS publish op risk research

Regulatory Update

Correlation and diversification effects in operational risk modelling

The Correlation Problem Technical Focus

Losses and lawsuits

Loss Database

EU CAD study published

Regulatory Update

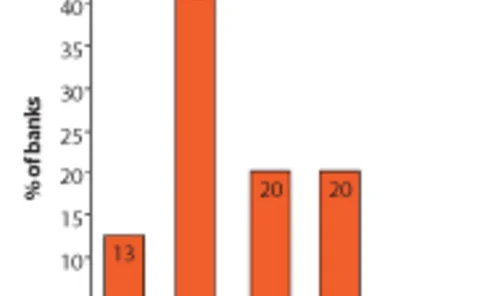

Fitch highlights discrepancies in banks’ op risk processes

Measurement Advances

John Kerry

profile

Steady progress - but could do better

Op risk data: Special focus

The top stories from RiskNews

RiskNews

Op risk assessment hampered by lack of reliable data

Inadequacy of loss expectation data is a major cause of modelling risk for operational risk strategies, said Carol Alexander, professor of the ISMA Centre at the University of Reading in the UK, at Risk's annual European conference.

Op risk assessment hampered by lack of reliable data

Inadequacy of loss expectation data is a major cause of modelling risk for operational risk strategies, said Carol Alexander, professor of the ISMA Centre at the University of Reading in the UK, at Risk’s annual European conference.

SEC approves alternative method of capital measurements for broker-dealers

The Securities and Exchange Commission (SEC) has approved a rule that allows certain broker dealers to use internal models to determine their capital requirements. The Commission believes the rule would improve its oversight of broker-dealers.

Observations on the differences between operational risk regulatory and economic capital

In this article, Niklas Hageback takes a practical look at the difficulties in reconciling regulatory and economic capital calculation in the discipline of operational risk.

Finding the perfect fit

With the implementation of Basel II firmly on the agenda for Japan's banks, Shunsuke Shirakawa of the Financial Services Agency talks about how the Japanese regulator will approach the challenges posed by the new Accord.

Taking on the big boys

Sean Egan, co-founder of Egan-Jones Ratings, talks to Dalia Fahmy about his frustration at the restrictive structure of the credit rating industry and his plans to turn Egan-Jones into a serious contender to rival established players, Moody's, S&P and…

Extensive revisions expected for EU CAD in July draft

Substantial changes in content will have occurred to the EU Capital Adequacy Directive (CAD) when the final EU Commission draft is published in July. And domestic European regulators are warning that further alterations will take place to the document…

Cutting capital

Across the banking spectrum, new technology is being used to help financial institutions reduce their capital requirements, writes Clive Davidson.